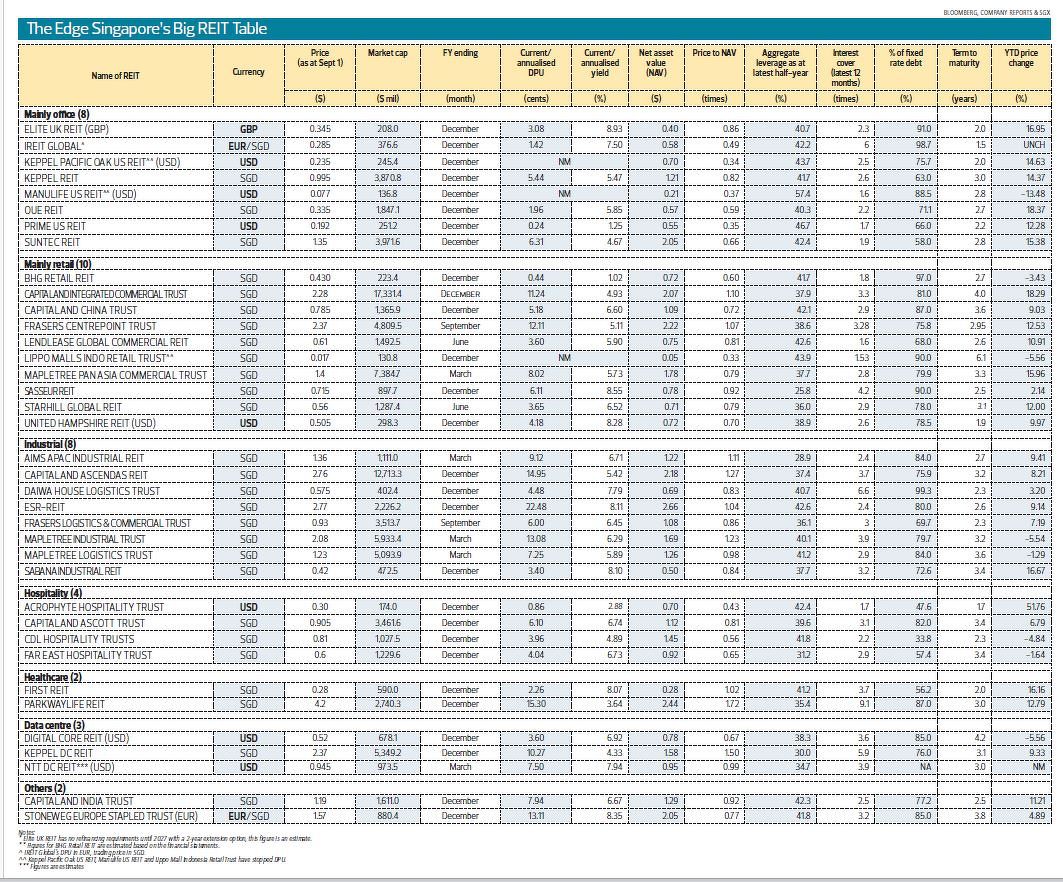

The top performer in price alone this year was Acrophyte Hospitality Trust Property Trust, partly because it had fallen to a low of 19.3 US cents (24.8 Singapore cents) in late 2024. Its distribution per stapled security in 1H2025 fell by 42% to 0.434 US cent.

The next best performers are OUE REIT and CapitaLand Integrated Commercial Trust (CICT), both up 18.3% this year in price alone. Among the two, OUE REIT has the higher distribution per unit (DPU) yield and an all-Singapore portfolio, one of only three REITs.

CICT is the largest REIT by market capitalisation in Asia ex-Japan, on par with Link REIT. Although Link REIT has the larger asset size, and lower aggregate leverage, it is trading at HK$41.40 ($6.82) compared to its net asset value of HK$63.6. CICT is trading at $2.28 versus its NAV of $2.07. Mainly, Singapore assets have been stable, and the Singapore dollar is a haven currency. CICT has benefitted as the largest S-REIT. In addition, its sponsor CapitaLand Investment is well-known for its mall management.

Morgan Stanley’s Singapore at 60 report cites Singapore as being the largest REIT market in Apac by 2035, overtaking both Japan and Australia. This would be through a combination of REIT IPOs and growth of the listed REITs.

The blue paper has also cited 20 REITs and four business trusts that could benefit from the Monetary Authority of Singapore’s (MAS) equity market development programme (EQDP). Specifically, the MAS has earmarked $5 billion for the EQDP. The aim is to increase investor interest in the Singapore equities market. Although banks and REITs are not included in the programme, Morgan Stanley believes that 20 REITs and CapitaLand India Trust (which is a property trust) could benefit.

The REITs range from Mapletree Pan Asia Commercial Trust, with a market cap of $7.4 billion to Sasseur REIT with a market cap of $897 million.

See also: OUE REIT’s growth playbook — Singapore-centric assets with interest rate tailwinds