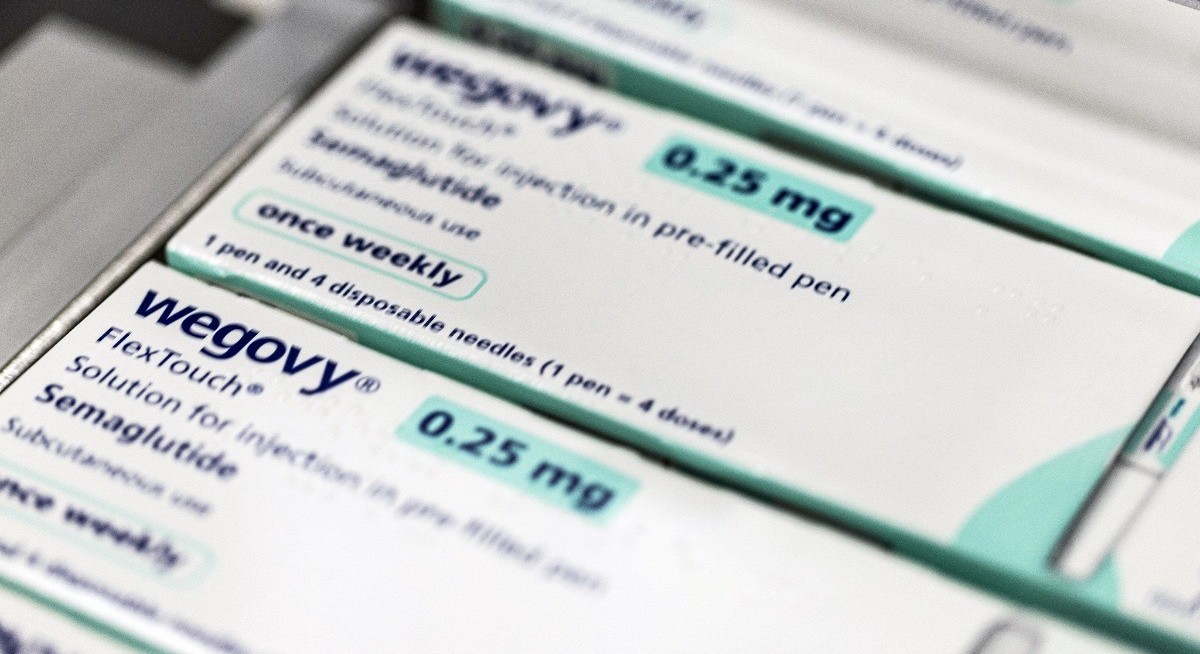

The shares soared by as much as 7.2% in early trading in Copenhagen. Novo’s stock has fallen by about half this year amid concern about the Danish drugmaker’s ability to compete in the obesity market it pioneered.

The approval was based on the results of the Oasis 4 trial, which found people taking a 25 milligram pill once daily lost about 13.6% of their body weight over 64 weeks. The company said it filed for approval in Europe and other parts of the world in the second half of 2025.

The pill is crucial for Novo’s strategy to take on Lilly, which has said its own oral obesity drug could be approved by March. That would give Novo a head start of just a few months.

See also: UK banks push to manage billions of pounds lying idle

The pill approval “gives Novo a much-needed win in light of recent challenges” maintaining market dominance, Evan David Seigerman, an analyst for BMO Capital Markets, wrote in a note. “Novo just won the regulatory race against Lilly.”

Even if the advantage is short-lived, Novo will benefit from the head start, Seigerman said.

The company plans to sell the 1.5 milligram starting dose of the pill to cash-pay patients at an introductory price of US$149 a month. Details about the cost for higher doses and the price for those using insurance will be disclosed closer to the time of launch, Novo said in an email, noting the insurance-covered price could be as low as US$25 per month across all doses.

See also: Dubai’s Bin Sulayem quits DP World after Epstein ties exposed

The pill is a new and convenient option, chief executive officer Mike Doustdar said in the statement. Novo argues that no other current oral GLP-1 treatment can match the weight loss the Wegovy pill delivers, citing an estimated 16.6% weight loss shown in the study if all patients stayed on the treatment.

Lilly’s pill delivered slightly less weight loss than Novo’s results in a separate study. However, patients will probably be able to take it with less regard to the timing of food and drink.

Novo has been struggling to compete recently in the obesity market it did so much to create. Its flagship drug Wegovy has lost ground to Lilly’s Zepbound, as a head-to-head trial showed Zepbound could help people lose more weight. Novo’s next-generation shot CagriSema also failed to deliver as much weight loss as the company had promised in studies.

The Danish drugmaker has said it will sell the drug via telehealth platforms as well as more traditional channels.

Uploaded by Felyx Teoh