Gains in these and other Asian stocks tracked earlier jumps in Canadian peers including Nouveau Monde Graphite Inc.

The Commerce Department affirmed the tariff in a document Thursday, and a final plan should be announced by Dec 5. The US determined that China, which dominates the processing capacity of graphite, had been unfairly subsidising the industry.

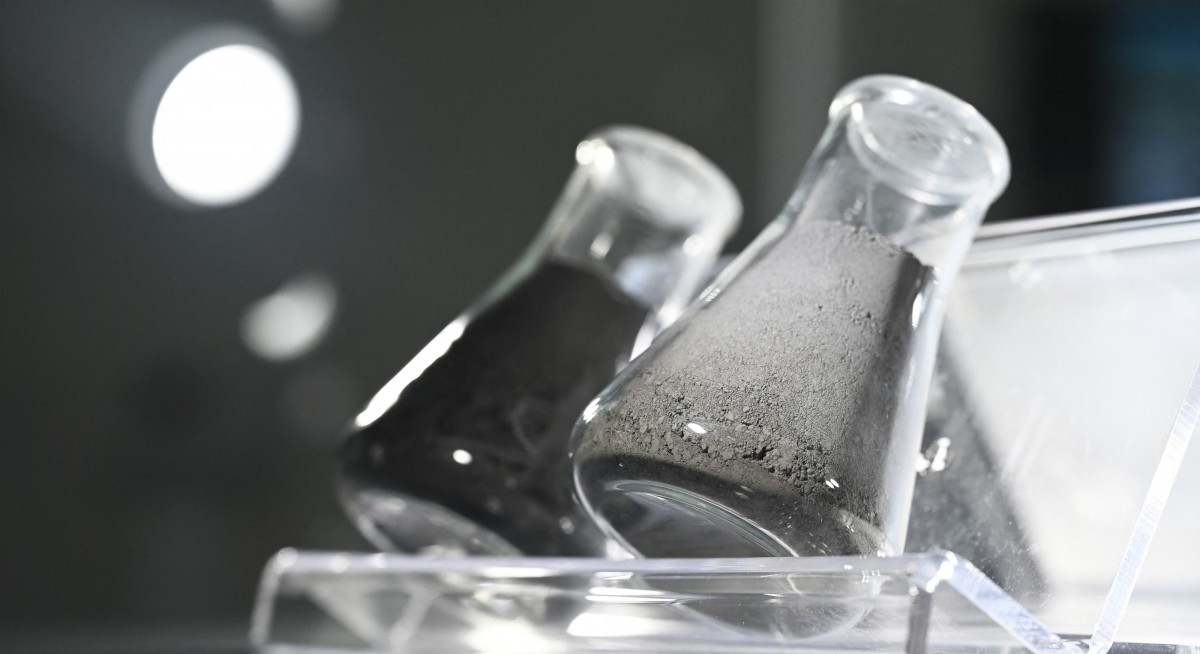

Graphite is a key raw material in the anodes of electric-vehicle batteries, and about two-thirds of the material imported by the US comes from China, according to BloombergNEF.

See also: Asian stocks set to climb after US CPI lifts mood

The US has sought to encourage EV makers to be less reliant on Chinese components with subsidy-qualifying measures under its Inflation Reduction Act.

“Expectations of IRA benefits coupled with US-China decoupling are boosting investor sentiment and driving up the share prices of related companies,” said Namho Kim, general manager of Timefolio Investment Management in Seoul.

“Battery material companies with lower reliance on China will emerge as key beneficiaries.”

See also: BofA says anything-but-dollar trade to lift international assets

Chinese suppliers including Hunan Zhongke Electric Co and Jiangsu Baichuan High-Tech New Materials Co traded slightly higher early Friday.

“The US is likely to be promoting the development of its own graphite industry by forcing domestic battery makers to switch suppliers,” said Eugene Hsiao, head of China equity strategy at Macquarie Capital.

“Thus upstream suppliers of Chinese graphite anodes are more likely to be impacted.”