(Jan 26): Germany’s business outlook slipped at the start of the year with the economy still lacklustre despite the promise of big government investments to come.

An expectations index by the Ifo Institute unexpectedly dropped to 89.5 from 89.7 in December, according to a Monday report. Economists in a Bloomberg survey had predicted an increase to 90.3. A measure for current conditions edged higher.

“The German economy is starting the new year with little momentum,” Ifo president Clemens Fuest said in a statement. The business climate increased sharply among manufacturers while deteriorating in the services sector.

Europe’s largest economy expanded in 2025 for the first time in three years, setting off a fledgling recovery that’s expected to be driven by government outlays on infrastructure and defence. While last year’s growth of 0.2% was still “unsatisfactory” for Chancellor Friedrich Merz, some of the latest forecasts offer reason for optimism.

The Bundesbank predicts the economy will pick up over the course of 2026, and the International Monetary Fund last week raised its outlook for the year to 1.1% expansion. Investors are similarly confident, with expectations at the highest level since mid-2021.

See also: Russia cuts key rate to 15.5% despite uptick in inflation

“January’s steady Ifo business climate reading reflects a slightly brighter outlook for a still struggling industry and cooling optimism in services. Overall, it offers little hope of a notable near-term pickup in Germany’s economy and reinforces our view that higher fiscal spending will deliver a larger boost only in the second half of 2026,” says Martin Ademmer of Bloomberg Economics.

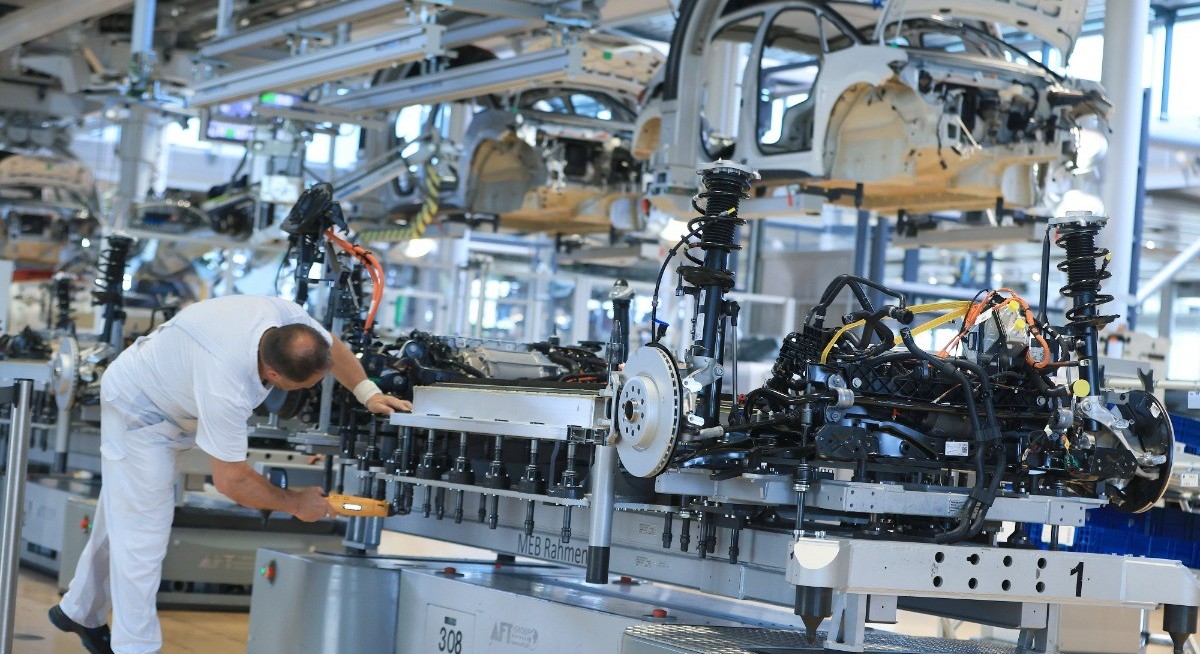

Challenges remain. A separate survey showed manufacturing continued to shrink in January, albeit at a slower pace than earlier, as firms struggle to navigate strained trade relations with the US and stiff Chinese competition.

Chemical-maker BASF SE reported a drop in earnings last week, underscoring a prolonged downturn in a sector grappling with excess capacity and weak demand, particularly from its key customer, the auto industry. Volkswagen, Porsche and Audi are all cutting German production capacity and headcount.

See also: BOJ hawk Tamura flags spring as possible timing for rate hike

On top of that comes renewed uncertainty about trade. US President Donald Trump threatened new tariffs last week over his plans for Greenland, and even though he retreated within days, the stunt served as a reminder that economic realities can shift overnight.

Uploaded by Felyx Teoh