(Nov 7): China’s exports unexpectedly contracted in October as global demand failed to offset the deepening slump in shipments to the US, dealing a blow to an economy already slowing amid sluggish consumer spending and investment at home.

Exports fell for the first time in eight months, dropping 1.1% from a year earlier, according to official data released Friday. Shipments to all nations except the US rose 3.1%, not enough to compensate for the more than 25% decline to America.

“The exporters in China have been frontloading their trade in order to avoid high tariffs in the US — it seems the frontloading finally faded in October,” said Zhiwei Zhang, chief economist at Pinpoint Asset Management. “Exports have been a key pillar for growth in China due to the weak domestic demand. Now that export momentum weakens, China needs to rely more on domestic demand.”

Chinese exports have been resilient until now, as other destinations made up for drops in shipments across the Pacific Ocean. Sales abroad had grown every month since February, when activity slowed because of the Lunar New Year holiday.

See also: China is a country of contradictions

See also: China’s MSCI presence expands for first time in nearly two years

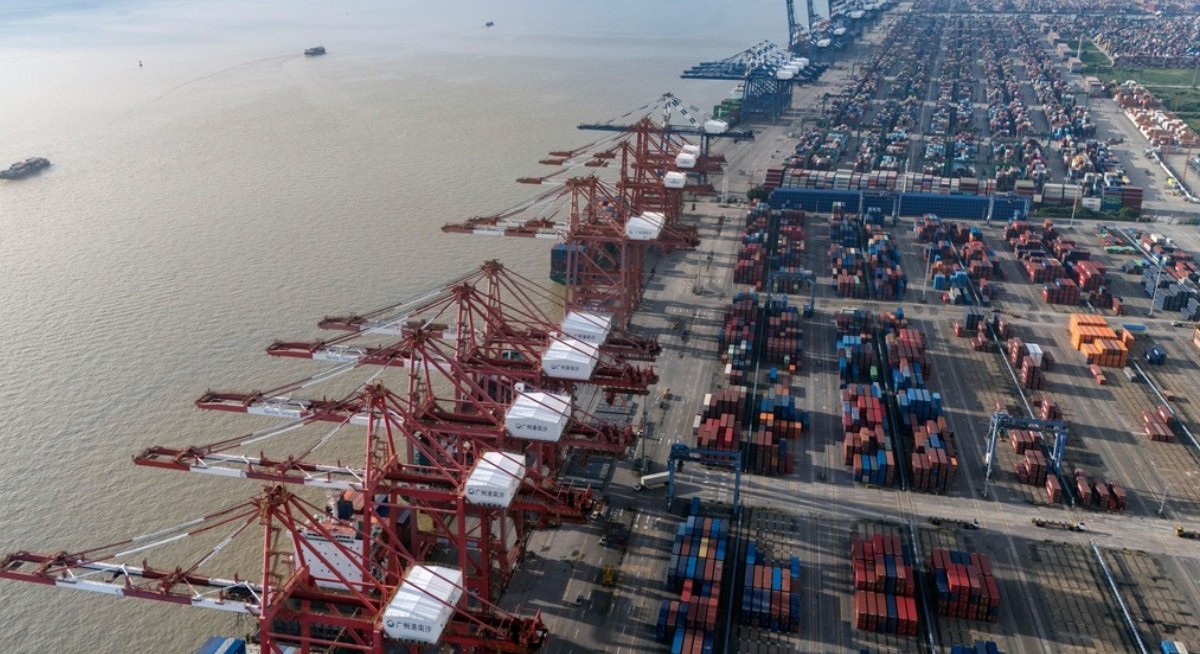

But October marked a break in the trend of growth driven by the pursuit of new markets among Chinese companies. A range of trade indicators started to cool off from the record numbers seen in earlier months, with Shanghai port processing the fewest containers since April.

The decline in overall exports in October came as a surprise to almost all forecasters, with the median estimate of those polled by Bloomberg at 2.9%. Only a single analyst in the survey had predicted a decline.

What Bloomberg Economics says...

“October’s surprise drop in exports suggests that China’s external resilience is starting to falter under high tariffs and global trade uncertainty. This highlights the need for Beijing to keep supporting domestic demand and prevent weak spending from dragging on growth..” — David Qu.

Tensions with the US over trade escalated last month, before a deal reached later in October by Presidents Donald Trump and Xi Jinping at talks in South Korea.

With the US reducing tariffs on Chinese goods by 10% from next Monday, it’s possible trade between the world’s two largest economies could see a pickup through the year-end. The effect may prove limited, however, because duties on Chinese goods are still higher than those on products from countries such as Vietnam.

And if the slowdown in demand from the rest of the globe continues, that could pull down shipments and the broader economy in the final two months of the year. Already last quarter China’s economic growth decelerated to the weakest pace in a year even as exports boomed.

To stay ahead of Singapore and the region’s corporate and economic trends, click here for Latest Section

It risks an even steeper slowdown in the months ahead. Analysts forecast the weakest growth this quarter since the final three months of 2022, when the nation was nearing the end of debilitating Covid Zero lockdowns.

The weakness looked to be broad in October, when shipments to the European Union climbed 1%, the slowest growth since a drop in February.

Exports to some other major markets fell, with sales to South Korea, Russia and Canada all dropping by double digits. China doesn’t report bilateral trade data with all nations in the first data release, with the remainder of the figures due later this month.

“In the next few months, China’s exports to other emerging markets will be placed under greater scrutiny by market participants,” said Homin Lee, a macro strategist at Lombard Odier Singapore. “They are crucial gauges for the market narrative of Chinese tech and consumer brands’ overseas expansion.”

Yet even with the overall drop in exports in October, they still exceeded US$3 trillion in the first 10 months of the year — the first time they’ve hit that mark so quickly. In combination, with weak imports for much of the year, the trade surplus has been setting fresh records, hitting US$965 billion so far in 2025.

China’s overall imports slowed sharply in October and grew 1%, leaving a surplus of US$90.1 billion.

The yuan provided less of a boost to exports after appreciating this year against the dollar and reaching its strongest in close to a year last month. The gains make Chinese goods relatively more expensive to customers abroad.

The weakness in sales to non-US markets in Latin America and the 10 Southeast Asian nations in the Asean group “hints that the yuan’s relative strength and Mexico’s import curbs are beginning to be a factor,” according to Lee at Lombard Odier Singapore.

Even so, Chinese export prices have fallen in every month but one since mid-2023 due to domestic deflation, compensating for the stronger currency and making shipments cheaper.

As a result, Chinese companies will likely continue to add to the inroads made abroad during the trade war with the US.

“While payback effects from earlier front-loading may weigh on export growth somewhat in the coming months, we expect China’s export growth to remain resilient in 2026 on structural tailwinds,” Goldman Sachs Group Inc analysts led by Xinquan Chen said in a note.

Uploaded by Liza Shireen Koshy