(Jan 19): China’s economy lost more momentum last quarter even as it met the government’s target in 2025, in another year of lopsided growth that will be hard to sustain in an era of protectionism around the world.

While industrial production held up well in December, retail sales and investment worsened more than forecast. The world’s second-largest economy expanded 4.5% last quarter from a year earlier, the slowest pace since the reopening from Covid lockdowns in late 2022.

For the full year, gross domestic product rose 5%, according to data released by the National Bureau of Statistics (NBS) on Monday, confirming an estimate given by President Xi Jinping in a speech on New Year’s Eve and matching the expansion in 2024. Chinese onshore stocks edged up slightly following the data release, while government bonds and the yuan were little changed.

“Despite achieving the 5% growth target, China’s economy actually posted weaker on-year growth one quarter after another in 2025, which shows domestic demand is still weak,” said Larry Hu, head of China economics at Macquarie Group. “The most important thing is not the headline growth, but whether China can break away from the current two-speed growth.”

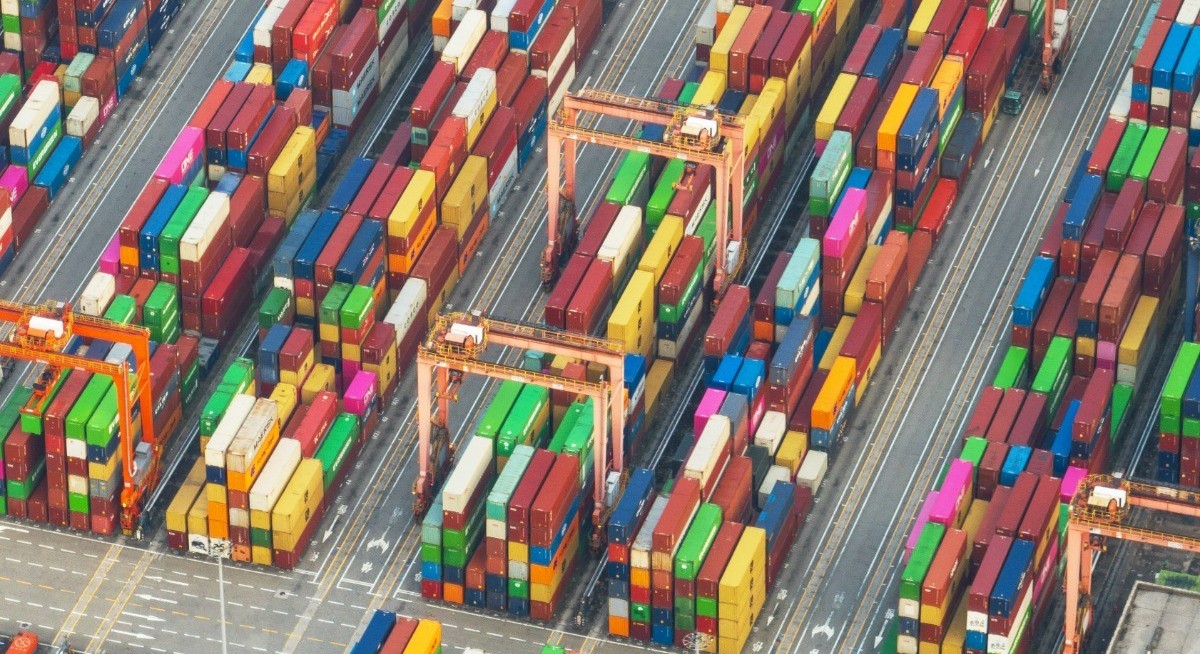

Consumer spending and business investment remain sluggish, as a weak jobs market and falling home prices weigh on domestic demand. But as China navigated growing trade barriers around the world, its manufacturing edge and the resilience of exporters have propped up factories, keeping growth in industrial output at well over 5% for most of last year.

See also: China’s US$7 tril cash pile is shifting into stocks, gold

Net exports contributed a third of economic growth in 2025, Kang Yi, head of the NBS, said at a briefing. That’s the highest level since 1997, when their share was 42%, according to official data.

This uneven growth pattern will likely persist in 2026. While Beijing shows greater willingness to help consumers, it’s unlikely to unleash massive stimulus as it continues to battle risks tied to local government debt.

Policymakers now confront the serious challenge of reaching the goal of making China a moderately developed economy by 2035, which would require an average growth rate of 4.17% over the next decade.

See also: China clamping down on high-speed traders, removing data servers — Bloomberg

The first quarter of 2026 could prove to be especially challenging, given the high base created by the economy’s rapid expansion a year ago thanks to export front-loading and consumer subsidies.

Highlights of China’s other key economic indicators:

- Industrial production rose 5.2% on year in December, the fastest pace in three months and slightly better than forecasts by economists

- Retail sales inched up 0.9% last month, the weakest since the Covid reopening and compared with an estimated 1% increase

- Fixed-asset investment contracted 3.8% in 2025, the first annual decline in data starting almost three decades ago. Property investment declined 17.2% in the year

- The urban jobless rate was 5.1% in December, unchanged from November

“The Chinese economy withstood multiple pressures and maintained steady progress in 2025,” the NBS said in a statement. But “the impact of the external environment is deepening, and the imbalance between strong domestic supply and weak demand is prominent. The economy still faces plenty of old problems and new challenges.”

After months of tariff chaos, China has emerged vindicated about the strength of its export-reliant economy that powered through Donald Trump’s trade war by boosting shipments outside the US. A record US$1.2 trillion goods trade surplus provided breathing room for top officials to seek a fix for vulnerabilities that range from deflationary pressures to a persistent housing crisis and demographic setbacks.

Nominal economic growth, which is unadjusted for price changes, was 4% in 2025, the slowest since 1976 excluding the pandemic year of 2020. The nation’s population shrank for the fourth straight year, with the number of babies born in 2025 dropping to a record of less than eight million and the birth rate reaching the lowest since 1949.

To stay ahead of Singapore and the region’s corporate and economic trends, click here for Latest Section

At times of weak price gains, nominal expansion is a more useful indicator because it better reflects changes in wages, profits and government revenue. As a component of household disposable income, wage growth slowed to 5.3% in the fourth quarter from a year earlier, the weakest pace since early 2023.

Deflation has now lasted for three straight years — a record streak since China began transitioning to a market economy in the late 1970s. Except for Japan, no other major economy has experienced such prolonged price declines since the end of World War II.

China’s leadership has pledged to “significantly” boost the share of consumption in its economy in the next five-year plan, which takes effect in 2026, while keeping tech and manufacturing as the top priorities.

Beijing has also vowed to stop the historic drop in investment this year, although it remains to be seen whether local officials will actually ramp up capital expenditure on the ground.

Xi has emphasised efficiency, and the government is moving to stop cutthroat competition among companies — a campaign dubbed “anti-involution” — to curb price wars that erode profits.

Beijing has stuck to a growth target of “around 5%” for the past three years. But global banks, including Goldman Sachs Group Inc and Standard Chartered plc, increasingly see the government lowering that goal to between 4.5% and 5% for 2026.

“Consumption will likely remain the laggard, with the magnitude of property easing still hanging in the air,” said Michelle Lam, Greater China economist at Societe Generale SA. Next year “should show resilient exports”.

Domestic demand was subdued last year, especially if excluding the effects of the government’s 300 billion-yuan (US$43 billion or $55.37 billion) subsidies for household purchases of consumer goods. Investment contracted in December at the fastest rate seen last year despite some modest stimulus that was added late in 2025, according to Jacqueline Rong, chief China economist at BNP Paribas SA.

While the room for fiscal stimulus this year is more limited than in 2025, monetary easing could play a more active role than last year given the downward pressure on the economy and the property downturn, she said, forecasting cuts in interest rates and banks’ reserve requirement as early as in March.

“It’s clear that domestic demand has remained extremely weak, while exports are unusually strong,” Rong said.

Uploaded by Chng Shear Lane