Revenue increased by 7% over FY2024 to US$67.4 million; net loss decreased slightly by 4% to US$10.4 million in the same period.

Gross profit margin for the whole of FY2025 was 28%, a slight dip from 29% generated for 2HFY2025, no thanks to a "challenging business environment" resulting from US tariffs.

Restructuring costs, specifically severance payment of US$3.1 million, weighed down the bottom line too, the company says.

Creative warns that the global market environment remains challenging, with US tariffs likely to cause inflationary pressures and thereby dampen consumer sentiment.

See also: Chuan Hup's earnings jump more than three times to US$2.1 million

"The full impact on the macroeconomic landscape remains difficult to ascertain," the company adds.

Creative says that following its most recent restructuring, it is now "leaner" and "better positioned" to manage ongoing external uncertainties.

It remains "committed" to "setting strategic priorities and building new capabilities while staying focused on the group's core competencies to drive long term, sustainable growth."

See also: Frasers Property generated $1.4 bil in pre-sold residential revenue

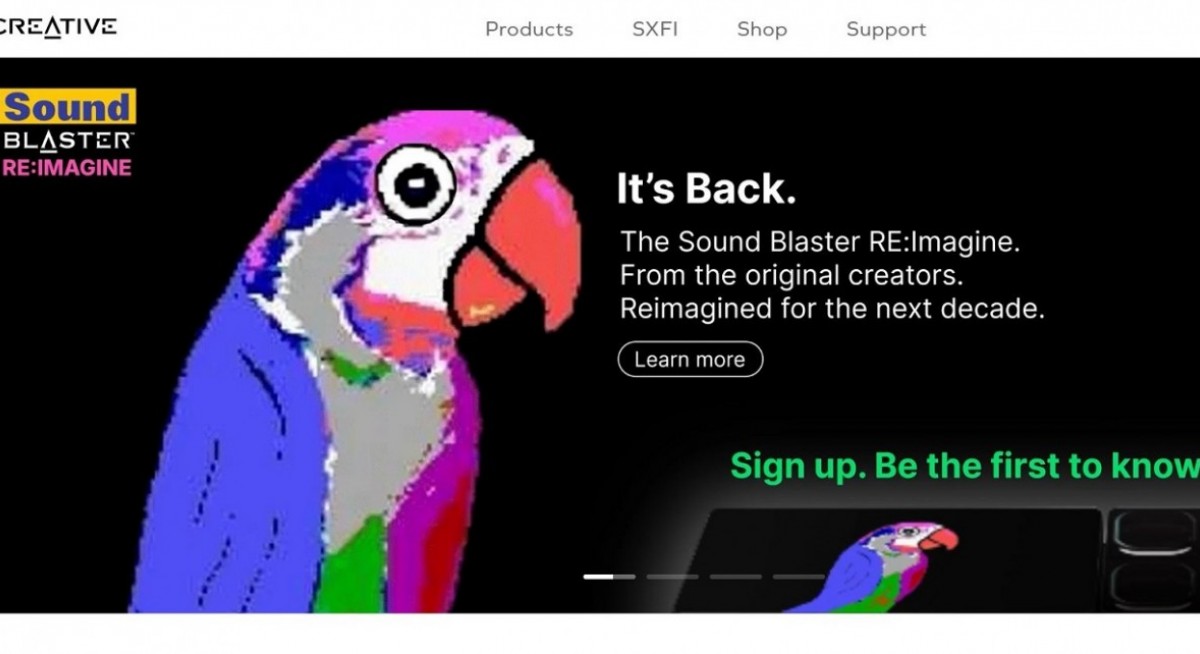

The company, famous for making it back during the nascent stages of personal computing for its line of Soundblaster-branded soundcards, has in recent days teased the introduction of a new variant of this iconic product, the "Soundblaster RE:Imagine."

Creative says that while external risks persist, it is cautiously optimistic and expects to see a steady improvement in revenue and operating performance in the current FY2026, due to operational efficiencies and ongoing strategic initiatives.

Creative Technology shares closed at 78 cents on Aug 22, unchanged for the day but down 31.42% year to date.