Both bids were above the previous record land rate. The third and lowest bid of $463.5 million came from a joint venture between Hong Leong Holdings subsidiary Intrepid Investments and TID, a joint venture between Hong Leong Group and Japan’s Mitsui Fudosan.

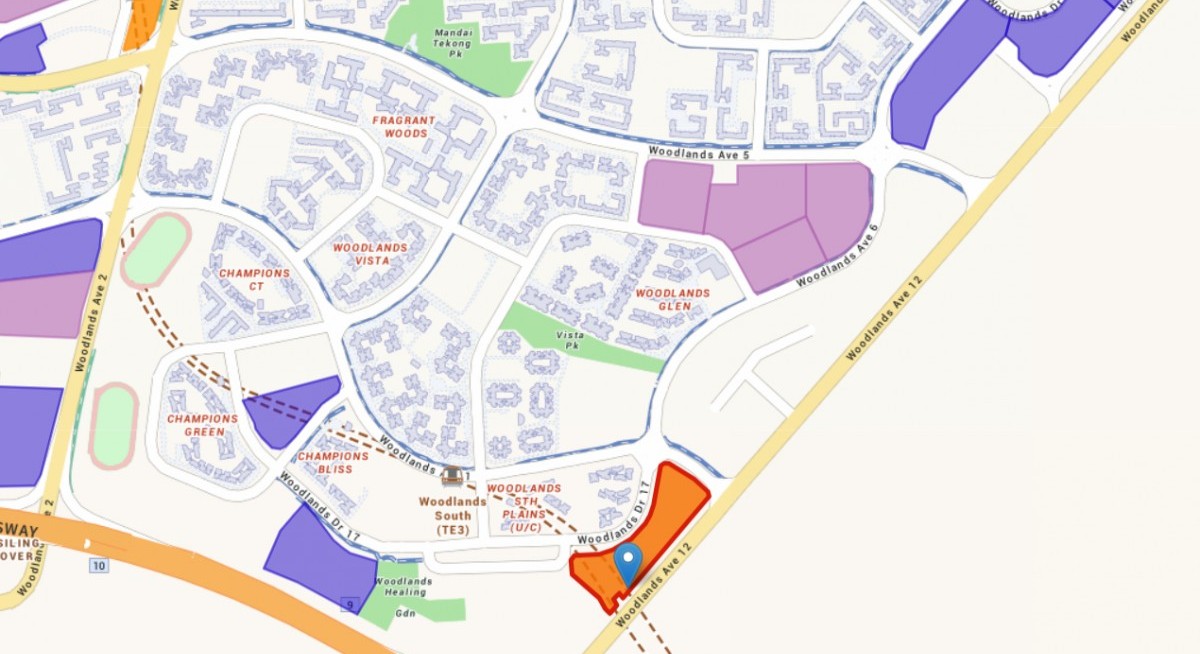

Launched for tender in October 2025 under the Confirmed List of the Government Land Sales (GLS) programme in 2H2025, the 26,979.9 sqm EC plot can potentially yield 560 new units and is about 7% larger than the first EC site.

Should Sim Lian be awarded the tender, its bid could translate into a possible launch price of “just above” $1,800 psf with an overall average price of between $1,900 psf and $2,000 psf, says Knight Frank Singapore research head Leonard Tay.

Wong Siew Ying, head of research and content at PropNex, thinks the average selling price may rise “above $1,850 psf”.

See also: At 14.6%, ski homes in Andermatt top price growth in the Alps: Knight Frank

CDL had edged out Sim Lian for the first Woodlands Drive 17 EC site by just $1 psf ppr, or 0.2%. Incidentally, CDL’s then-record $782 psf ppr bid had smashed the previous high set by Sim Lian’s $768 psf ppr bid for a Tampines EC tendered in October 2024.

‘Pent-up demand’ in Woodlands

See also: CapitaLand downplays Mapletree merger rumours; preps second C-REIT IPO and data centre platform

Wong says there is “pent-up demand” for new ECs in Woodlands, where there have been no new EC launches since 2016’s Northwave.

Prior to Northwave, the previous new EC launch was BelleWoods in 2014. “It is likely that the depth of demand for new EC units, including among HDB upgraders, may be able to support sales at the two future EC projects in Woodlands Drive 17.”

Over 2,700 four-room and five-room HDB flats will be reaching their minimum occupancy period (MOP) in 2026 and 2027 from the nearby towns of Woodlands, Sembawang and Yishun, which could further contribute to upgrader demand, notes Justin Quek, deputy group CEO of Realion (OrangeTee & ETC) Group.

Quek anticipates “strong demand” for the future project thanks to its proximity to Woodlands South MRT Station on the Thomson-East Coast Line (TEL), at just 200m away.

There are also “numerous” primary and secondary schools in the area, which may appeal to families with school-going children, he adds.

The site will also be “quite near” the upcoming Johor Bahru-Singapore Rapid Transit System (RTS) via the TEL, says Quek. “There may be keen demand for the project in the future from foreigners after the EC is privatised.”

Developers ‘confident’

The review of the income ceiling for buyers of EC units may have been one reason for the confident bid, says Mark Yip, CEO, Huttons Asia. “A higher income ceiling will mean a larger pool of demand when the project is launched in 2027. There were some 6,600 HDB flats completed from 2016 to 2021, which may be potential upgraders.”

The mid-sized EC development of up to 560 units “offers an attractive entry into the EC market for developers”, says Eugene Lim, key executive officer, ERA Singapore. “With a manageable size and a price quantum of less than $500 million, it presents developers with a more measured level of risk.”

Factoring in the 15-month wait-out period, the project is expected to be launched in early to mid-2027, says Lim. This could bring the total number of EC launches in the North to as many as three in 2027, collectively adding about 1,245 units to the market.

The North is poised to see a flurry of EC launches from end-2026 to 2028. To date, two EC sites in Woodlands and one in Sembawang have been made available, while the tender for the Miltonia Close (Yishun) site is set to close in April.

Moreover, the 1H2026 GLS Confirmed List features two more EC sites in the North — at Canberra Drive and Sembawang Drive.

Currently, there are another six private and two EC sites open for tender, notes Lim. In 1H2026, a further seven private and two EC sites will be available to developers. “The unsuccessful bidders this round may pivot to other opportunities for EC sites at Miltonia Close, Canberra Drive and Sembawang Drive.”