Elsewhere, on Sept 18, European stocks advanced, with Paris and Frankfurt up more than 1% and London higher, while Asia was mixed as Tokyo gained, Hong Kong and Shanghai slipped, and Seoul closed at a record high.

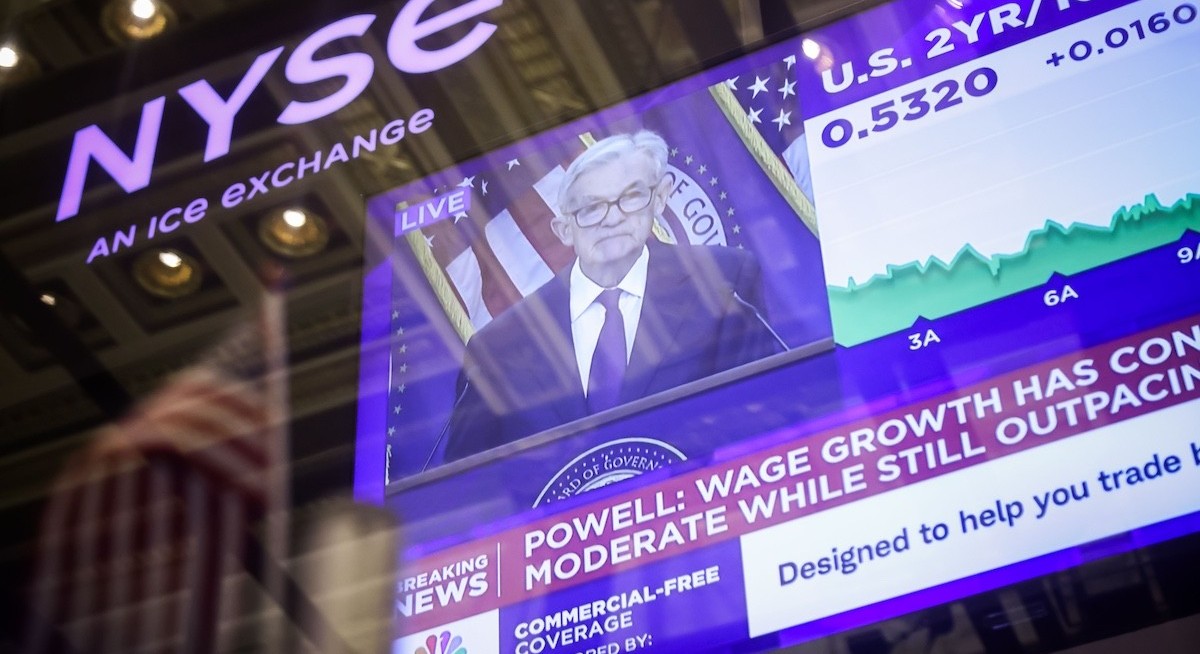

The Bank of England also maintained its rate 4% on Sept 18, on the back of sticky inflation in the UK. Central banks in Norway and Canada have also cut rates. Across the Atlantic, the Fed’s first cut this year takes the target range to 4%– 4.25% and comes with a split in views on how many more moves are warranted. Chair Jerome Powell calls the approach “meeting by meeting” and frames the decision as risk management amid softer labour data and still-elevated inflation.

The formal statement notes that growth of economic activity moderated in the first half of the year, while job gains have slowed, and that downside risks to employment have risen. Quantitative tightening continues, with the Fed reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities.

Bank J Safra Sarasin says the outcome largely matches expectations. “As expected, the Fed cut policy rates by 25 bps, with no dissenters except for the new Governor Miran who duly voted for a half-point cut. The ‘median dot’ now signals three cuts this year, one more than before. Beyond that, the path remains unchanged with rates gliding back to close to the 3% equilibrium by the end of 2027,” says the bank, while noting that Powell highlighted the Fed’s “rare dilemma” in which its dual mandate is pulling in opposite directions. Powell also warned that there are “no risk-free paths now”.

See also: Why relevance matters more for SGX, says head of equities Ng Yao Loong

Barclays argues the cut adds to a rising global liquidity impulse and tilts the balance toward cyclicals and emerging markets if the US dollar weakens. Possible USD softness should be “bullish” for risk assets, especially emerging market equities, opines the team of analysts led by Emmanuel Cau.

With equities near highs and the rates market still pricing in [roughly five] additional cuts over the next year, Barclays says further upside depends more on resilient data than on extra dovish signalling. The bank also flags that global money supply across the US, EU and China is growing faster than GDP, boosting credit impulse and purchasing managers’ indices.

Powell’s press conference underscores the competing forces. He says tariffs are beginning to push up some prices, but that the overall effects on economic activity and inflation remain to be seen. On labour, he points to immigration trends, noting: “There’s very little growth, if any, in the supply of workers.”

See also: SGX-Nasdaq dual-listing framework stirs up ‘real buzz’ but technical issues expected

He adds that “a quarter point won’t make a huge difference to the economy”, that policy is not on a pre-set path, and stresses independence when asked about internal dissent and litigation around the board.

Bonds and currencies

Fixed income managers broadly welcome a slow but steady easing path, while cautioning that market pricing may be ahead of the data. “Chair Powell’s dovish pivot at August’s Jackson Hole Symposium… sparked a broad rally across bond markets,” say George Bory, chief investment strategist for the fixed income team, and John Campbell, senior portfolio manager, at Allspring Global Investments. “The FOMC validated Chair Powell’s more dovish stance by approving the 25 bps rate cut.”

They note that the yield curve’s modest flattening signals growth concerns now outpacing inflation fears. “Federal funds futures are currently pricing in four to five rate cuts over the next 12 months, which may be overly aggressive,” they add. Bory and Campbell expect a total of 100 bps in cuts over the next 12 months. Over the past month, US Treasury yields declined by approximately 25 bps across the curve, with the two-year hovering around 3.5%.

From their perspective, the front end remains anchored by central bank expectations, the long end is the relief valve, and a consolidation phase is likely. “With the Fed in a slow-but-steady easing mode now, we believe bond prices should remain well supported, particularly at the front end of the curve,” they say.

Meanwhile, Rick Rieder, BlackRock’s chief investment officer of global fixed income, says the Fed is clearly reacting to a softening labour market, citing revisions that witnessed a downward adjustment of about 911,000 jobs over the past year and further weakness in recent months. Rieder expects another two 25 bps cuts this year and probably a continuation of at least a moderate rate cutting cycle next year. In portfolios, BlackRock prefers duration “in the front to belly of the yield curve”, noting improved hedging correlations and still historically attractive levels of income as spreads remain supported.

Debt sustainability concerns will not vanish simply because policy rates are falling, Bank J Safra Sarasin cautions. Risk premiums have pushed real yields above estimated real potential growth in many markets, implying a need for primary fiscal surpluses to stabilise debt. “Some form of fiscal consolidation will be unavoidable to shore up investor confidence and to prevent a credibility crisis that would require more drastic measures,” says the bank.

For more stories about where money flows, click here for Capital Section

Navin Saigal, head of fundamental fixed income, Asia Pacific, at BlackRock, says Asia is already easing and could accelerate. “Most Asian markets continue to price in very shallow easing cycles and steeper yield curves, suggesting that investors stand to benefit from owning Asian bonds if last night’s Fed cut leads to a broader easing cycle,” he adds. With inflation in Asia generally below target, he believes that Asian central banks may find themselves with more space than expected to ease, and a longer duration position in Asia can be highly complementary to a global fixed income portfolio.

Jeff Ng, head of Asia macro strategy at Sumitomo Mitsui Banking Corporation (SMBC), expects a measured pace of rate cuts of 25 bps every quarter. The way Ng sees it, Asia may benefit from lower yield differentials against the US, though fundamentals and tariff differentials will drive uneven flows.

SMBC expects the USD to weaken by 2%–3% for the coming year, with some Asian currencies gaining up to 5%. Ng is more optimistic of inflows supporting currencies like the Malaysian ringgit, Singapore dollar, Taiwan dollar and Korean won (MYR, SGD, TWD and KRW), while cautioning that SGD gains may be more limited against the S$NEER policy band. He adds that Taiwan and Malaysia face “limited urgency to cut” and still sees the Bank of Japan hiking in October and again in 2026 under the base case.

On the dollar and risk assets, Kerry Craig, global market strategist at JP Morgan Asset Management, says the Fed’s messaging aimed to reconcile higher growth and inflation projections with rate cuts by leaning into labour market softness. The median path could see two more cuts this year, one more in 2026, and another in 2027, he says.

According to Craig, Powell did not push back on the market pricing for the policy path, but did not endorse it either. Craig expects that the path towards lower rates will support risk assets in the US and elsewhere, with a weaker USD aiding emerging market (EM) equities and local currency debt. Tight investment-grade and high-yield spreads can still be used to barbell any duration positions in the shorter end of yield curves as these curves steepen.

Asia watch

Asian policy will not move in lockstep with the Fed. “Copycat action in Asia will depend on the spread between the US and current rates in the various countries,” says Morningstar’s Tan. “We noted that in Hong Kong and Singapore, interest rates had actually fallen ahead of the US rate cut. As a result, we think that there may be less pressure for Asian central banks to react.”

On China, Tan adds: “The PBOC [People’s Bank of China] decision is not too surprising as the Fed move was largely built into recent actions. The RMB [Chinese renminbi] has been strengthening a bit recently and this allows the PBOC a bit more flexibility in its policy to lower interest rates to help support the economy. We think this is possible as there are signs that the economy is again softening a bit in the face of global uncertainty.”

Michael Makdad, senior equity analyst at Morningstar, adds that even in Hong Kong the link is looser in practice. “Although Hong Kong’s currency peg ties its monetary policy directly to what the US Fed does, in recent quarters the path of Hong Kong’s local interest rates has diverged increasingly from those of the US due to economic divergence and liquidity flows,” he says.

Meanwhile, Makdad notes that liquidity flows also pushed down Singapore’s local interest rates well ahead of any Fed action. So the immediate impact of the Fed’s move this week on Asian banks and interest-rate-sensitive sectors like real estate should be limited.

On equities, Charu Chanana, chief investment strategist at Saxo, calls this “the start of an easing cycle” and says the focus for long-term investors is how different assets respond. The way she sees it, easier policy reduces financing costs and improves valuations, and leadership could broaden beyond mega-cap technology.

Within technology, the real story is in structural AI themes — semiconductors, cloud, and power-hungry data centres, where earnings strength can persist even as the largest caps look stretched. Utilities can act as bond proxies when yields fall and also sit at the centre of the AI power boom, as electricity demand and grid investment rise.

Banks may lag initially as lower policy rates squeeze net interest margins, but if cuts extend the cycle and keep credit healthy, loan growth and lower defaults can help, with large US banks resilient and EM banks benefiting from a softer dollar.

Chanana says REITs gain from lower yields, while US homebuilders face the offset of potential oversupply. Small caps could stage a catch-up as borrowing costs fall, although balance sheet strength is crucial. A weaker dollar may draw more flows into EM, with Asia’s exporters and commodity-linked markets well placed, but the strongest candidates combine solid external balances and reform momentum.

Her bottom line is that capital-heavy sectors with long-dated cash flows, such as miners, utilities, renewables, infrastructure, pipelines and REITs, should gain more than the average when financing costs ease, particularly when paired with structural demand from AI power, electrification and the energy transition.

Allspring’s equity team expects the rally to broaden beyond a handful of mega-cap names. The Fed’s dovish turn “bolstered already-strong equity markets, with more impact…on US stocks versus international stocks and smaller-capitalisation names versus larger ones”. Small and mid caps look attractive on relative valuation grounds, barring a full-blown recession. Lower fixed income yields can revive interest in high-dividend equities as a partial substitute for bonds, echoing the dynamic from the zero-interest-rate policy era.

Overall, risks remain. For Saxo’s Chanana, they are sticky services inflation, a potential “bad cut” if growth deteriorates, AI execution bottlenecks, political pressure on the Fed, a sharp USD rebound and geopolitical flashpoints that could redirect flows into the dollar or gold. Blackrock’s Rieder similarly warns that labour may be the harder leg of the dual mandate over the next few years as productivity and technology gains lower both inflation and labour demand. Powell himself stresses there are “no risk-free paths now”.

In Asia, investors are already re-pricing rate paths and sector winners. India’s Nifty IT index rallied on the cut then faded as traders took profits, with HCL Tech, Infosys and peers slipping on Sept 19. Korean chip names rallied on reports of tighter curbs on Nvidia’s China sales. Across Asean, SMBC sees currencies like MYR, SGD, TWD and KRW supported by modest USD weakness, with SGD gains constrained by the S$NEER band. Morningstar expects limited immediate impact on banks and developers in Hong Kong and Singapore since local rates had fallen ahead of the Fed.