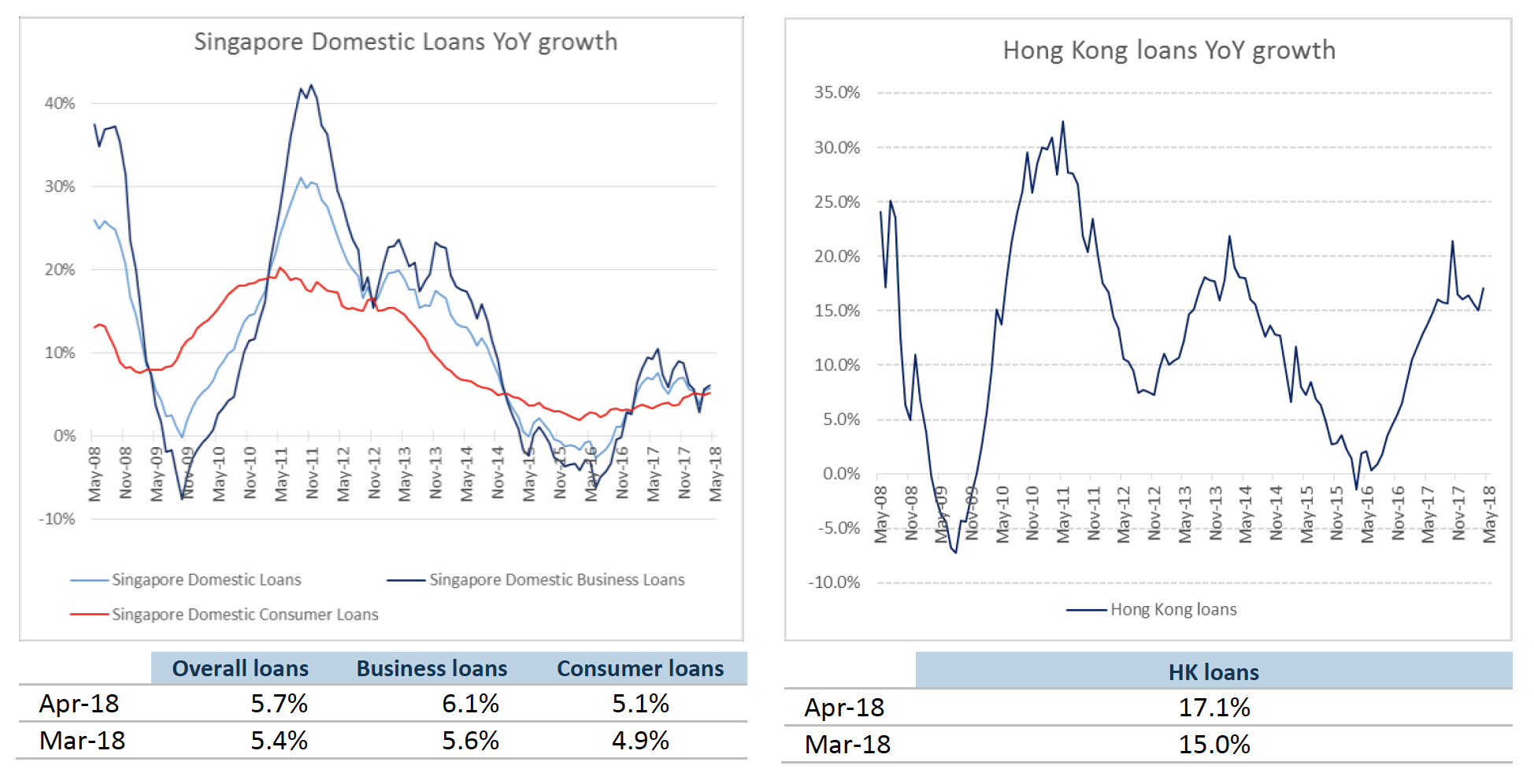

In Hong Kong, loans in April grew 17.1% y-o-y – the fastest in six months. Loans growth was supported by HKD loans growth of 25% y-o-y, boosted by IPO financing. Excluding IPO, HKD loans rose 19%. Hong Kong's residential volume and value showed renewed vigour after some weakness in January. According to JLL Hong Kong, May residential sales volume was up 55.9% m-o-m and value was up 59.3% m-o-m, driven by demand from first-time homebuyers and the ability of developers to drive up prices in the secondary market where supply is limited.

In Hong Kong, loans in April grew 17.1% y-o-y – the fastest in six months. Loans growth was supported by HKD loans growth of 25% y-o-y, boosted by IPO financing. Excluding IPO, HKD loans rose 19%. Hong Kong's residential volume and value showed renewed vigour after some weakness in January. According to JLL Hong Kong, May residential sales volume was up 55.9% m-o-m and value was up 59.3% m-o-m, driven by demand from first-time homebuyers and the ability of developers to drive up prices in the secondary market where supply is limited.

In the meantime, SIBOR and SOR to continue their upward trend. Three-month SIBOR crept up in May to near 10-year highs. Tin expects the Singapore banks’ NIMs to be on a gradual upward trend given expectations of three or more Fed rate hikes this year. This means NIM expansion will provide the main share price catalyst for the next few quarters. Despite the 40bps increase in SIBOR this year, mortgage loans growth has remained resilient at 4.4% y-o-y. Therefore, Tin does not expect new mortgage loans to be adversely affected by the gradual increase in SIBOR.

See also: PhillipCapital, UOB Kay Hian raise respective target prices for BRC Asia following 1QFY2026 earnings

In addition, offshore oil and gas operating conditions are improving although recovery is weak. Global jackup utilisation rate has bottomed out in February and is now hovering around 60%. However, Tin says global day rates have been on a downward trend and short-term recovery is unlikely because utilisation rates have not reached high enough levels for offshore contractors to enjoy much pricing power. Oil prices rose but charter fees stayed flat even though the volume of business increased.

“The industry is burdened by structural overcapacity and is unlikely to see a recovery in profitability in the short term,” concludes Tin.

As at 10.20am, shares in OCBC are up 12 cents at $12.65, shares in UOB are up 19 cents at $28.29 while shares in DBS are up in 31 cents at $28.61.