"As Intel is a long-standing customer of AEM, this collaboration is expected to provide indirect benefits to AEM through increased demand and expanded product opportunities," says KGI.

Prior to the Nvidia-Intel announcement, AEM had already deepened its ties with Intel, via a collaboration with Intel Foundry to broaden access to its potential customers of its testing services.

"The initiative aims to accelerate time-to-market for fabless customers by offering a comprehensive, integrated testing solution that includes device-specific configurable test units and advanced thermal control," says KGI.

Key benefits include faster commercialisation timelines, lower capital expenditure, and access to a U.S.-based engineering and production ecosystem. "This partnership not only strengthens AEM’s industry positioning but also enhances its strategic value to stakeholders," says KGI.

See also: Citi keeps ‘buy’ on CLI at $3.40 TP on ‘proactive’ M&A exploration and growing FUM

Having reported 1HFY2025 revenue of $190 million, an improvement of 9.6% y-o-y, KGI expects AEM to record even higher sales in the current 2HFY2025, driven by its largest customer and pull-in orders from other clients. The deployment of a new tester called the AMPS-BI was a major contributor.

Newly-appointed CEO, Samer Kabbani, has painted a "constructive" outlook, flagging AEM's next-generation test technologies that are now ready for high-volume production.

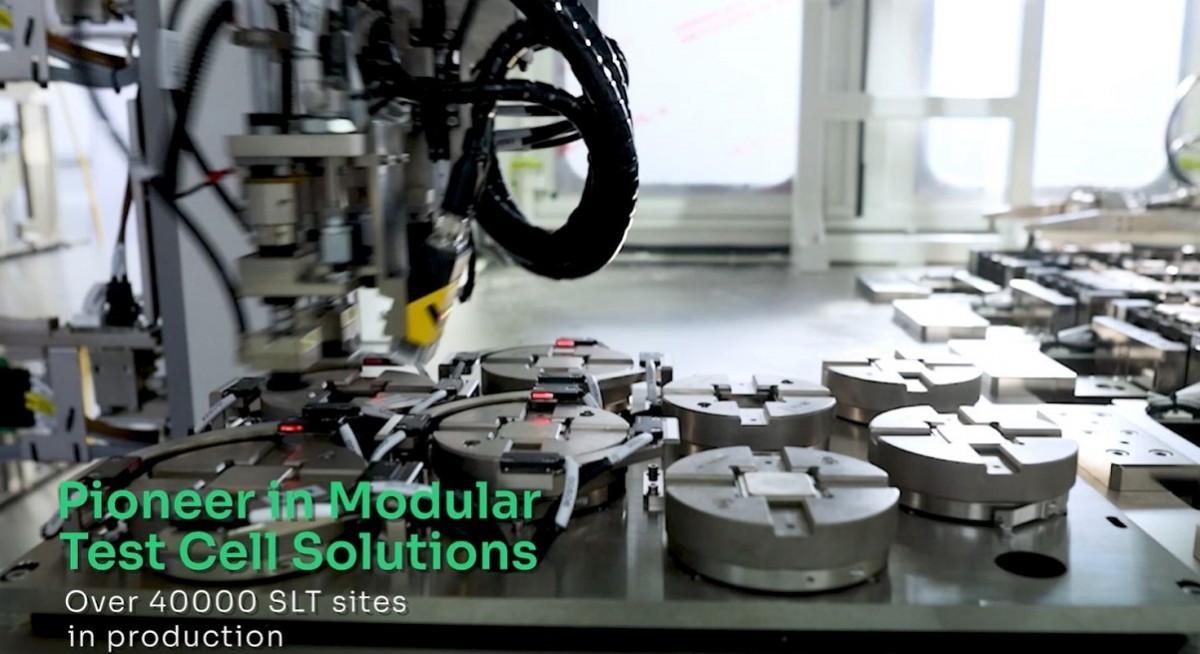

"This positions AEM for its next phase of execution and expansion as it partners with customers to address their most critical challenges. Although the contract manufacturing segment has faced softer demand due to global trade uncertainties, AEM’s core test-cell solutions remain a strong driver of future growth," says KGI.

AEM shares changed hands at $1.86 as at 1.25 pm, down 3.12% for the day but up 28.28% year to date.