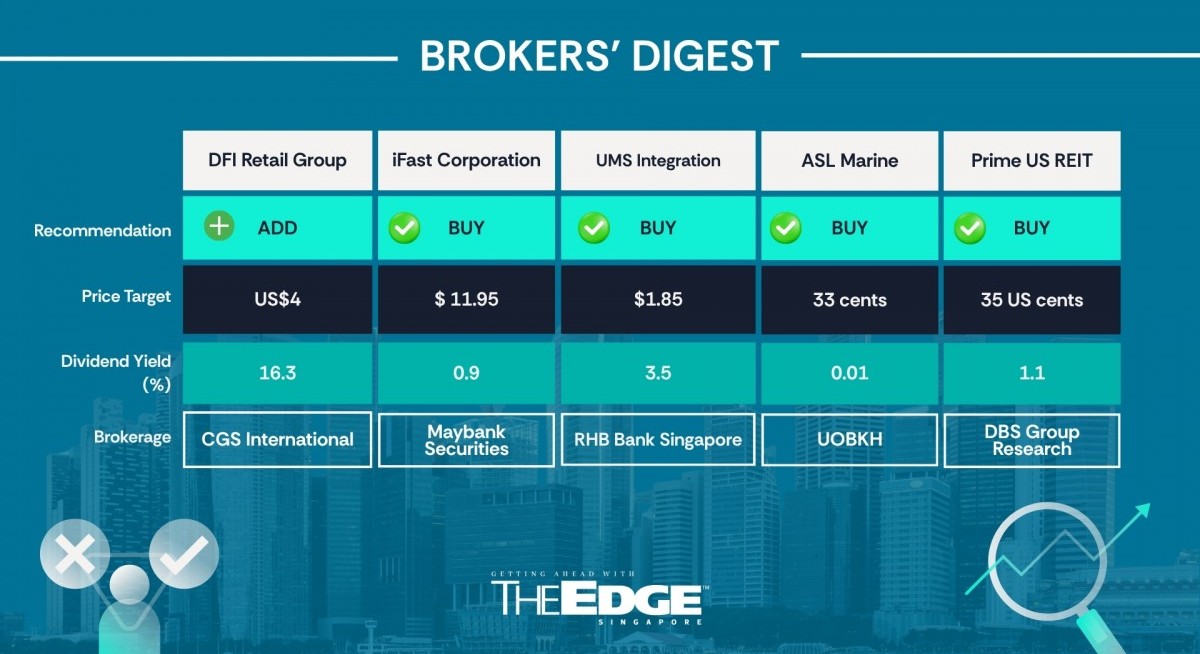

CGS International ‘add’ US$4

Possible acquisitions

CGS International is keeping an “add” call, while raising its target price to US$4.00 ($5.22) from US$3.45 on DFI Retail Group ahead of the group’s first-ever Investor Day here on Dec 3.

Analysts Meghana Kande and Lim Siew Khee expect management to focus on medium-term financial targets and its inorganic strategy to drive revenue growth following its recent portfolio divestments.

See also: PhillipCapital, UOB Kay Hian raise respective target prices for BRC Asia following 1QFY2026 earnings

To recap, DFI announced on Oct 30 its 3QFY2025 ended Sept 30 business update, which reported that underlying profit rose 48% y-o-y, driven by a 23% y-o-y increase in operating profit, lower financing costs and higher associates’ contributions following the divestment of Yonghui in February and Robinsons Retail in May.

Sales momentum picked up in 3QFY2025, growing 3% y-o-y (excluding cigarettes), compared to flat y-o-y in 1HFY2025. DFI’s food and health & beauty segments were key drivers of sales growth.

Food segment like-for-like (LFL) sales were up 3% y-o-y, primarily on stronger sales in Singapore from the government’s voucher disbursement, which, alongside better profitability in Hong Kong, contributed to the doubling of operating profit in 3QFY2025 y-o-y. The health & beauty segment saw LFL sales and operating profit grow 5% and 7% y-o-y, respectively, in line with the analysts’ expectations.

See also: Citi ups target prices on all three banks; prefers Singapore banks over SGX for EQDP play

Meanwhile, convenience segment sales (excluding cigarettes) were stable y-o-y on a LFL basis while network expansion of 7-Eleven in China and shift in sales mix towards ready-to-eat products supported 3QFY2025 profit growth. Sales of the home furnishing segment in Hong Kong and Taiwan improved, while cost controls aided profit.

DFI maintained its FY2025 underlying profit guidance at US$250 million–US$270 million, which implies 16%–32% y-o-y growth in 2HFY2025 or 3%–17% y-o-y growth, excluding Yonghui and Robinsons.

“We think this is conservative in light of DFI’s profit momentum in 3QFY2025 and the seasonally stronger 4QFY2025, particularly due to a later mid-Autumn festival versus 2024, which should partially push Maxim’s mooncake sales into 4QFY2025. Accordingly, we now expect FY2025 underlying profit to be US$278 million (previously US$263 million),” say Kande and Lim, while raising their FY2026-FY2027 net profit forecasts by 6%–7%, underpinned by DFI’s stringent cost controls and improving Hong Kong supermarket profitability.

However, they note that the sale of the Singapore food business, scheduled to be completed by the end of the year, is likely to dampen growth, as they expect a turnaround in profitability.— Samantha Chiew

iFast Corporation

Price target:

Maybank Securities ‘buy’ $11.95

For more stories about where money flows, click here for Capital Section

Macro and regulatory tailwinds

Maybank Securities analyst Toh Xuan Hao has initiated a “buy” call on iFast Corporation with a target price of $11.95. Toh’s target price, based on a FY2026 P/E of 29.5 times, benchmarked against the peer average P/E of 39.17 times, a 6.6% weighted average cost of capital, and 4% terminal growth, represents a 23% upside from iFast’s last-closed share price of $9.72 as of Oct 30.

In Toh’s Oct 30 note, he highlighted that the recent turnaround of iFast Global Bank (iGB) is a near-term growth catalyst for iFast.

Deposits have surged 92.7% y-o-y in 3QFY2025, and Toh expects the base to be more than double to $2 billion by the end of FY2025, which will boost interest revenue and assets under administration (AUA) growth, driven by its focus on UK migrants underserved by incumbents and the seamless integration with its wealth platform.

Toh believes that the growth of the deposit base will increase iFast’s FY2025 interest revenue to $92 million.

Regarding the ongoing rollout of Hong Kong e-Pensions, Toh mentioned that the rollout remains on track, supported by strong visibility driven by scale. While iFast’s management trimmed near-term profit before tax guidance due to higher staff costs, iFast believes that this is necessary to meet the electronic Mandatory Provident Fund’s (eMPF) 1QFY2026 onboarding deadline.

Based on Toh’s estimation, he expects the increase in staff costs to decelerate to an increase of 14% y-o-y by FY2027, versus an increase of 52% y-o-y in FY2025, which paves the way for a 3.19 percentage points increase in ebitda margin by FY2026.

With iFast’s seven-year contract (plus three-year option) yet to reach peak revenue, Toh expects Hong Kong’s net revenue contribution to rise to 57.4% by FY2026, from 45.5% in FY2024.

Meanwhile, macro and regulatory tailwinds are set to reinforce iFast’s positioning. Toh observes that geopolitical volatility and tariff risks are driving safe-haven flows into Hong Kong and Singapore, with both exchanges already posting record volumes.

Meanwhile, MAS’s EDQP reforms are expected to expand market participation. As a result of rising market activity, Toh forecasts segmental revenue to grow at a three-year CAGR of 20% for Hong Kong and 19% for Singapore.

With over 80% of AUA concentrated in these two countries, Toh believes that iFast is well-positioned to benefit from volatility-led inflows and structural reforms. — Teo Zheng Long

UMS Integration

Price target:

RHB Bank Singapore ‘buy’ $1.85

Beneficiary of semiconductor growth

Alfie Yeo of RHB Bank Singapore has started coverage on UMS Integration with a “buy” call and $1.85 target price, viewing the company as a long-term beneficiary of the semiconductor sector’s growth.

“Short- to medium-term growth should be driven by an increase in semiconductor equipment spending, ramp-up in new customer orders and margin expansion,” states Yeo in his Oct 31 note.

UMS is now trading at a P/E of less than 1, which is deemed “compelling” at 18 times FY2026 P/E against its FY2024–FY2027 earnings growth CAGR of 20% and below the peer average of 21 times.

According to Yeo, UMS offers a recovery play on the front-end semiconductor sub-sector. The wafer fabrication equipment segment is expected to grow by 7% y-o-y in 2025 and 10% y-o-y in 2026, according to the most recent projections by industry association Semiconductor Equipment and Materials International (Semi).

As indicated by Semi, growth will be driven by first, leading-edge logic, memory and technology transitions; investment in capacity expansion; and leading-edge production from chip innovations, backed by AI applications, data centres, high-performance computing and automotive electrification. “This makes UMS a key beneficiary of the semiconductor equipment growth trend,” says Yeo.

In addition, UMS has reduced its reliance on what was its key customer, Applied Materials. Since last March, via its expanded presence in Penang, UMS has been serving Lam Research, which has helped lower customer concentration risk, says Yeo.

With an eye on mitigating risks of sanctions, the new customer has a strategy to grow its fab capabilities in Malaysia. “We expect new product introductions from the new customer to contribute to its new order ramp-up,” says Yeo.

For context, UMS’s revenue in Malaysia in 1HFY2025 more than doubled y-o-y to $17 million from $5 million, and he expects this strong growth to continue, backed by orders from its new customer.

Overall, UMS’s 1HFY2025 earnings grew 6% y-o-y to $20 million on $125 million in revenue. “We expect growth to be fuelled by the continued recovery of the semiconductor sector as well as the ramp-up in orders from its new key customer,” says Yeo.

He warns that downside risks include a later-than-expected demand recovery, slow progress of new customer order ramp-up, and geopolitical supply chain shifts. — The Edge Singapore

ASL Marine

Price target:

UOB Kay Hian ‘buy’ 33 cents

Major turnaround

UOB Kay Hian analyst Heidi Mo has started coverage on ASL Marine with a “buy” call and a target price of 33 cents. Mo’s target price is based on FY2026 P/E of 11.6 times, which is a 15% discount to its peers’ average of 13.8 times, reflecting ASL Marine’s smaller size and liquidity.

In her Nov 3 report, Mo pointed out that FY2025 marked a major turnaround for ASL Marine as net profit surged 287% y-o-y to $14.7 million, driven by stronger project execution and margin expansion.

Excluding the $10 million of non-cash amortisation, core net profit would have been $24.7 million. With legacy restructuring charges now fully resolved, ASL Marine enters FY2026 with a clean slate and steady profitability.

In terms of capital management, ASL’s five-year club term loan refinanced $150 million of maturing bonds with neither lender haircut nor shareholder dilution, signalling creditor confidence. “The facility is collateralised by $268 million of assets at market value and bears a competitive rate of 2.5%,” Mo says.

As part of its fleet optimisation programme, ASL Marine plans to dispose of vessels worth $52.6 million in FY2026-FY2027 to fund debt repayment, targeting net gearing of 0.5 times, from 1.32 times currently. The annual interest savings of $7 million to $8 million are expected to lift ASL Marine’s net margins by three percentage points and accelerate free cash flow generation.

The higher margin ship repair segment, which contributes 50% of revenue, provides steady earnings for ASL Marine, supported by structural tailwinds from an ageing global fleet and an upcoming third floating dock.

“Long-term charter contracts worth $82 million and an $83 million shipbuilding order book underpin visibility from FY2026–FY2027, alongside exposure to Singapore’s major national infrastructure projects like Tuas Mega Port,” she notes.

Some of the potential re-rating factors for ASL Marine includes sustained deleveraging, margin stability and dividend resumption. — Teo Zheng Long

Prime US REIT

Price target:

DBS Group Research ‘buy’ 35 US cents

Dawn is here

DBS Group Research analysts Derek Tan and Dale Lai have restarted coverage on Prime US REIT with a “buy” rating and target price of 35 US cents (46 cents), backed by its discounted cash flow. The latest target price implies a target dividend yield of 4.3% and a target P/B of 0.65 times.

The optimism is based on how the US office market is showing clearer signs of stabilisation, with leasing demand and occupancy metrics improving across major markets.

“We view Prime as a value proxy to the US office sector, which is showing early signs of recovery in recent quarters,” say Tan and Lai in their Nov 3 note. “We believe Prime US REIT has moved past its worst times.”

According to Cushman & Wakefield and JLL, tenant activity strengthened in 3Q, as leasing volume rose 6.5% q-o-q to 52.4 million sq ft, which is close to post-pandemic highs, with 18 of the 53 tracked markets having surpassed pre-pandemic leasing levels.

They project Prime US REIT’s occupancy rate to reach 90% by the end of FY2025/1QFY2026, supported by the signing of new long-term leases across key assets, which will bring its weighted average lease expiry to 4.7 years.

The recent equity fundraising of US$25 million, while 10% dilutive to its net asset value, provides Prime US REIT with essential capital to undertake ongoing and future capex plans, support offering tenant incentives, strengthen liquidity and provide higher payouts.

With available cash and undrawn debt facilities, Tan and Lai estimate an overall liquidity of about US$120 million, which underpins Prime US REIT’s ability to resume distributions and fund operational needs to increase occupancy closer to 90%.

The REIT has increased its payout ratio from 10% to 50%, implying FY2026–FY2027 yields from 6.2% to 7.4%. In the manager’s opinion, the payout ratio could be raised if operational performance continues to strengthen.

Overall, both analysts view Prime US REIT as a value proxy for the US office sector, which is showing early signs of recovery in recent quarters. Prime US REIT’s ability to ride on the thawing office market fundamentals to drive higher occupancies and cashflows puts it on a firmer footing to start meaningful distributions, ahead of its listed US office S-REIT peers. — Teo Zheng Long