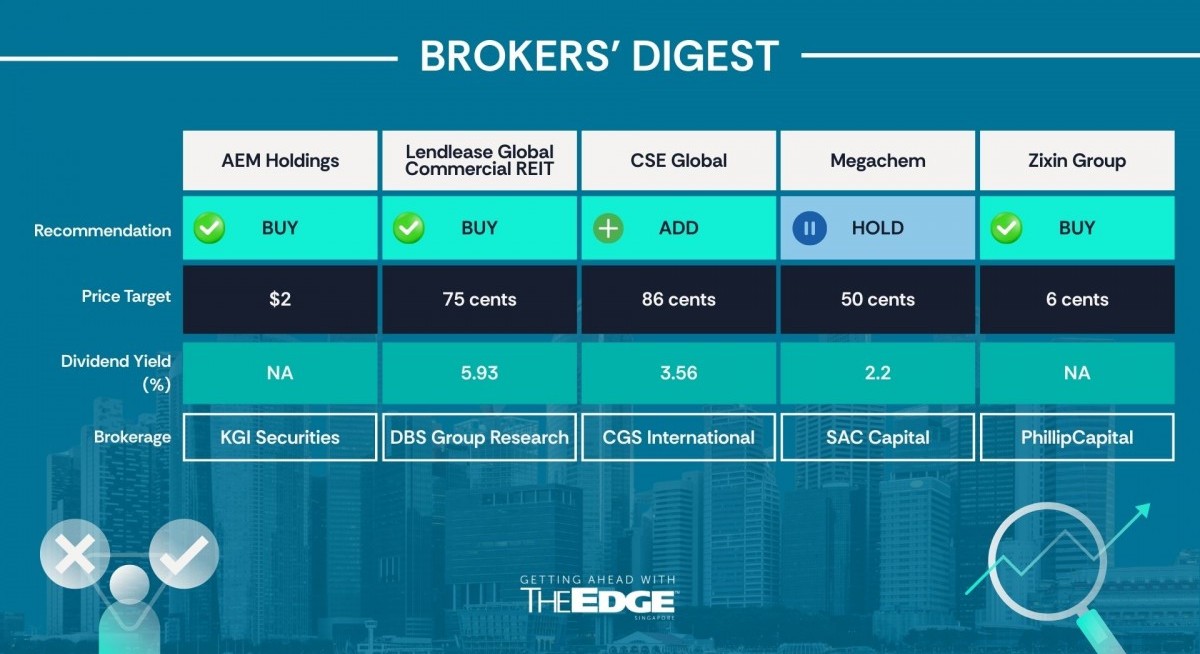

KGI Securities has maintained its “buy” call and $2 target price on AEM Holdings after news that Intel Corp, its key customer, is receiving US$5 billion in investment from Nvidia Corp as part of a broader product partnership.

Under the agreement, Intel will design custom central processing units that power everything from smartphones and laptops to automobiles, seamlessly integrated with Nvidia’s chips and systems across data centres and personal computers.

“As Intel is a long-standing customer of AEM, this collaboration is expected to provide indirect benefits to AEM through increased demand and expanded product opportunities,” says KGI.

Before the Nvidia-Intel announcement, AEM had already deepened its ties with Intel through a collaboration with Intel Foundry to broaden access to its testing services for potential customers.

See also: IFAST share price dips despite strong earnings 4QFY2025 announcement; DBS maintains ‘buy’ at $12

“The initiative aims to accelerate time-to-market for fabless customers by offering a comprehensive, integrated testing solution that includes device-specific configurable test units and advanced thermal control,” says KGI.

Key benefits include faster commercialisation timelines, lower capital expenditure, and access to a U.S.-based engineering and production ecosystem.

“This partnership not only strengthens AEM’s industry positioning but also enhances its strategic value to stakeholders,” says KGI.

See also: DBS, BofA and UOB retain ‘buy’ on Singtel as 3QFY2026 tops expectations

Having reported 1HFY2025 revenue of $190 million, an improvement of 9.6% y-o-y, KGI expects AEM to record even higher sales in the current 2HFY2025, driven by its largest customer and pull-in orders from other clients.

The deployment of a new tester, called AMPS-BI, was a major contributor. Newly appointed CEO Samer Kabbani has painted a “constructive” outlook, flagging AEM’s next-generation test technologies that are now ready for high-volume production.

“This positions AEM for its next phase of execution and expansion as it partners with customers to address their most critical challenges. Although the contract manufacturing segment has faced softer demand due to global trade uncertainties, AEM’s core test-cell solutions remain a strong driver of future growth,” says KGI. — The Edge Singapore

Lendlease Global Commercial REIT

Price target:

DBS Group Research ‘buy’ 75 cents

Possible acquisition of PLQ mall an ‘overall positive’

DBS Group Research is maintaining its “buy” call and $0.75 target price on Lendlease Global Commercial REIT, following suggestions that it may be poised to acquire a 70% stake in PLQ mall.

The event, if it materialises, is an “overall positive”, says DBS in its Sept 23 note.

For more stories about where money flows, click here for Capital Section

According to Tony Lombardo, CEO of Lendlease Group, the REIT’s sponsor, ADIA, or the Abu Dhabi Investment Authority, is considering selling its 70% stake in the PLQ mall. Lendlease holds the remaining 30%.

According to the Australian Financial Review, the asset, which boasts over 340,000 sq ft of retail space, is reportedly valued at more than $1 billion. Less than two months ago, Lendlease REIT announced the divestment of another asset, the JEM office, for $462 million, to Keppel. This sale is expected to be completed by the end of 2025.

Assuming proceeds are fully utilised to reduce debt, the REIT’s gearing will be lowered to 35% from its current level of 42.6%. This means the REIT will then have the debt capacity to fuel its growth ambitions.

PLQ is long known to be in the right of first refusal pipeline for Lendlease REIT, and the mall has entered its second renewal cycle, thus being deemed stabilised.

“While timing of an acquisition could be early, the opportunity to acquire a quality mall could be too good to pass, especially when the current low interest rates, with Sora at around 1.45%, are an enabler for an accretive deal to happen,” says DBS.

Assuming a net property income yield of 4.5%, based on the asset value of $800 million (70% stake), DBS estimates that a deal structured with half equity and half debt will pass the DPU hurdle to acquire Adia’s 70% stake in the asset, while holding its gearing at below 40%.

“In our view, assuming the acquisition, PLQ will be overall positive for Lendlease REIT with the addition of one of the newest and best-built malls in the East of Singapore, anchoring it as an emerging pure-play retail S-REIT,” says DBS. — The Edge Singapore

CSE Global

Price target:

CGS International ‘add’ 86 cents

Growing data centre power infrastructure pie

Lim Siew Khee and Tan Jie Hui of CGS International have maintained their bullish view on CGS International, calling the engineering firm one of their top picks among Singapore stocks due to its role as a supplier of power infrastructure to data centres.

“We expect CSE to expand its electrification orders to more hyperscaler customers, and or larger in contract size with its planned capacity expansion,” state Lim and Tan in their Sept 19 note, where they’ve kept their “add” call.

“CSE is well positioned to leverage the US hyperscale power boom and accelerate order wins in 2HFY2025,” add the analysts, who have maintained their target price at 86 cents.

With the likes of so-called hyperscale providers such as Amazon, Microsoft, Google and Meta, the US is the world’s largest and most mature data centre market.

“The demand for modular electrical houses and substations continues to accelerate, driven by the rapid expansion of hyperscale infrastructure,” the analysts say.

The US modular electrical houses market is estimated by Grand View Research to be worth US$304 million in 2024 and is projected to grow at a CAGR of 4% to US$449 million by 2033.

The US data centre substation market, on the other hand, is valued at US$3 billion in 2024, with a CAGR of 9% from 2025 to 2030.

Assuming that 80% of CSE’s data centre electrification products and services target the e-house segment and 20% address substations, the CGSI analysts estimate that CSE’s total addressable market for data centre electrification in the US was US$930 million in 2024.

Year to date, Lim and Tan estimate that the company has secured $80 million to $90 million in data centre contracts, with electrification order wins contributing $59 million.

They expect the data centre electrification order wins to grow to $65 million to $75 million by the end of the current FY2025. Lim and Tan observe that in recent months, several US hyperscalers have announced major data centre and AI infrastructure expansion plans.

To support the rising power infrastructure demand from CSE’s existing hyperscaler clients, CSE will need to expand its real estate footprint, as it is currently facing land constraints for building additional e-houses and substations. The company is now utilising 450,000 sq ft of fully utilised land, and this is expected to grow by up to 300,000 sq ft by early FY2026 to accommodate growth requirements.

The CGSI analysts note that, with its ability to deliver both electrification and communication solutions — both critical for hyperscaler scalability — it is well-positioned to differentiate itself from the competition and capture more integrated, high-value contracts.

Their target price of 86 cents is pegged to 15 times FY2026 earnings, which is 0.5 standard deviations above its 10-year average. — The Edge Singapore

Megachem

Price target:

SAC Capital ‘hold’ 50 cents

Exposure to growth sectors

Chemicals supplier Megachem, which suffered a warehouse fire in FY2023, has reported a mixed set of 1HFY2025 results. Earnings were down 15.8% y-o-y to $1.68 million on the back of a slight 1.7% drop in revenue to $64.1 million.

However, the company was able to improve its gross margin from 23.8% in 1HFY2024 to 1H FY2025. In addition, to signal confidence in its financial recovery and commitment to improve shareholders’ value, Megachem plans to pay an interim dividend of 0.5 cents per share.

The company, which is rebuilding its warehouse, expects to complete this by the end of this year. The new warehouse can store more than 5,000 pallets, helping to reduce its reliance on other warehousing operators and thereby incur lower storage costs.

Megachem aims to handle 70% of its storage needs in-house. “The construction of Megachem’s new two-storey warehouse will provide a major boost to its operational efficiency and cost management,” write Matthias Chan and Liu Maorong of SAC Capital, who are keeping their “hold” call.

The analysts point out that Megachem, which provides various kinds of speciality chemicals used in semiconductors, advanced electronics, and data centre infrastructure, is well-positioned to capitalise on the growth trends of these products.

The company’s surface technology segment covers semiconductor fabs, electronics manufacturers and other potential beneficiaries of the booming AI and data centre sectors, contributing 27% of total revenue.

Chan and Liu see another opportunity for Megachem within the broader green trend. Specifically, Singapore is positioning itself as a global leader in the production of sustainable aviation fuel (SAF).

Governments globally, including Singapore’s, have set mandates that map steady increases in the percentage of SAF in planes’ fuel tanks in the coming years.

“As global decarbonisation efforts gather pace, Megachem stands to benefit directly from rising SAF adoption, reinforcing its exposure to one of the most important sustainability megatrends,” add Chan and Liu.

However, there are a few risks, such as macroeconomic & geopolitical headwinds, volatility in chemical prices and regulatory and environmental hazards.

For now, to reflect cost savings from warehousing, Chan and Liu have raised their FY2026 earnings estimate by 22% to $6.2 million, which reflects warehouse cost savings.

By applying the same 30% discount to the peer mean forward P/E of 21.8 times, they have derived a target price of 50 cents, up from the previous target of 39 cents. — The Edge Singapore

OKP Holdings

Price target:

UOB Kay Hian ‘unrated’

A ‘bargain’ in Singapore infrastructure upcycle

UOB Kay Hian’s (UOBKH) Singapore research team has identified OKP Holdings (OKP) to be a “bargain” in Singapore’s infrastructure upcycle.

The team notes that OKP’s “undemanding” valuation is supported by its strong earnings growth. In 1HFY2025 ended June, the group’s net profit surged 61% y-o-y to $19.1 million, backed by expanded margins driven by “higher quality” projects. This translates to an FY2025 P/E of nine times.

“Excluding its sizeable net cash balance of $115 million, OKP trades at just 6 times ex-cash P/E, or a deep 30% discount to its peers’ average of 13 times FY2025 P/E per Bloomberg, suggesting room for a valuation re-rating,” writes the team in their Sept 22 un-rated report.

Another point of strength is OKP’s order book. As of June, the group’s order book of $648 million provides earnings visibility through FY2031. In May, OKP secured its largest-ever contract, a $258 million project from the Land Transport Authority (LTA), to build the East Region cycling path.

On this, the team writes: “This positions OKP as a key beneficiary of LTA’s plan to more than double Singapore’s cycling path network from 530 kilometres in 2024 to 1,300 kilometres by 2030.”

Despite project recognition, the group’s pipeline remains robust. The UOBKH analysts see that the group is well-positioned to “ride” on the recovery of the construction sector, supported by public infrastructure spending.

OKP’s “A1 grading” allows it to participate in public projects of “unlimited value”, according to the analysts.

At the same time, OKP has maintained a sizable net cash position since FY2023. As of 1HFY2025, the group’s net cash position increased 6.2% to $115 million, representing 44% of its current market cap.

“Such balance sheet strength provides ample buffer against sector cyclicality, enhances tendering ability for large-scale projects and leaves flexibility for selective acquisitions aligned with its core construction business. Shareholders continue to benefit as well, with payout and dividend yields increasing,” writes the team.

Meanwhile, the analysts point to “less capital-intensive” commuter facilities and cycling path projects supporting margins.

Although OKP’s maintenance segment’s margins compressed to 9.5% on competitive pricing, the segment still provides “stable, recurring” cash flows, which sustain its market share.

The analysts write: “Together with recurring rental income from its property investments, OKP has income stability across cyclicality. As OKP refocuses on its construction core competency, scale efficiencies, and disciplined tendering help sustain its competitiveness despite foreign entrants.”

Two share price catalysts noted by them include the group’s continued benefitting from the construction sector’s uplift and its financial resilience. — Douglas Toh

Bumitama Agri

Price target:

RHB Bank Singapore ‘neutral’ $1.10

Valuations now fair following share price rerating

RHB Bank Singapore is maintaining a “neutral” stance on Bumitama Agri, with an increased target price of $1.10 from $0.88 previously.

“Bumitama Agri’s share price has risen significantly post-results, likely due to its continued high dividend payout. Although results were above expectations, this trend was similar to its Indonesian peers during the quarter,” says the Singapore research team in a Sept 22 report.

“With the bulk of Indonesian planters posting stronger-than-expected numbers this quarter, the main differential that sets Bumitama apart is its high dividend payout ratio and yield,” says RHB, adding that the group upped its official payout ratio to at least 60% (from 50%) in 2024, and has been following through on this, paying out 64% of earnings in FY2024 and 50% in 1HFY2025 so far.

The research team believes that the stock is trading at a fair valuation two standard deviations and has reflected a significant portion of the dividend upside, with its FY2025 dividend yield now at 6% (down from 8% before the results).

Bumitama’s share price has risen significantly after the announcement of its 2QFY2025 results, which were slightly above expectations, at 57%–58% of RHB’s and street FY2025 forecasts.

Meanwhile, RHB has also lifted earnings projections to account for the higher domestic prices of CPO in Indonesia (as Bumitama is a pure domestic Indonesia play), in light of the still relatively tight supply situation there due to the ongoing biodiesel mandate.

“We note, however, that production is improving in Indonesia and is expected to continue to rise in 3QFY2025 — so CPO prices may moderate from current levels over the next few months. Our more conservative price assumption of IDR12,961/kg ($1/kg) (1HFY2025: IDR1493/ kg) is also reflective of this view,” says RHB.

That said, the group continues to manage its increasing external purchases of fresh fruit bunches (FFB), likely due to long-term relationships with smallholders and plasma farmers.

In 1HFY2025, its external and plasma FFB purchases rose 23% y-o-y. In light of the high base in 2HFY2024, RHB projects this growth to moderate to 14% by FY2025.

Nevertheless, the strong external FFB purchases should help boost the group’s overall CPO output, as the RHB research team expects nucleus output to grow by a smaller 4.7% in FY2025 (1HFY2025: 7%).

With that, RHB takes into account the slightly higher domestic average selling prices (ASP) and increases FY2025–FY2027 net profit forecast by 6.2%. 7.7% and 3.0% to IDR2.58 trillion, IDR2.6 trillion and IDR2.46 trillion.

“We believe Bumitama should trade closer to its peer average, given its decent earnings prospects and higherthan-peers’ dividend yield. Despite the higher P/E target, we believe its share price has reflected a lot of the dividend upside already, with FY2025 dividend yield now at 6% (versus closer to 8% previously),” says RHB. — Samantha Chiew

Zixin Group

Price target:

PhillipCapital ‘buy’ 6 cents

Share options plan a signal of chairman’s confidence

Liu Miaomiao of PhillipCapital has maintained her “buy” call and 6 cents target price for Zixin Group following the company’s plan to issue share options to a group of investors, including Chairman Liang Chengwang, which could potentially raise around $26.6 million.

From Liu’s perspective, this commitment by Liang and other investors underscores the long-term commitment and confidence in the company’s growth trajectory.

At $26.6 million, it is equivalent to around half the company’s current market cap and will be used to fund Zixin’s expansion plans in Hainan and Singapore.

Some 889 million share options with an exercise price of 30 cents each in five years. Liang himself will take up 300 million share options, approximately one-third of the total.

His stake will increase to 21.9% of the enlarged share base, assuming he fully exercises his options.

According to Liu, Zixin can expect to start generating revenue from its new production in Hainan in FY2027, which will be an addition to its existing presence in Fujian province.

In addition, Liu expects revenue for Zixin’s cultivation and supply segment to grow 27% y-o-y, driven by a 25% expansion in cold storage capacity. She notes that sweet potato prices have been on an upward trajectory, up 8.8% year-to-date, thanks to increasing health consciousness in China and rising popularity among younger consumers.

The company has also secured two new orders for animal feed, which gives more traction to a fledgling revenue stream.

Meanwhile, processed sweet potato sales will remain the key earnings driver, thanks to new product development such as sweet potato chips and functional products.

Liu expects sales to grow 28% y-o-y in the current FY2026, as the new factory commences operations, as well as the launch of Zixin’s own proprietary brands.

She expects Zixin’s FY2026 patmi to increase by 16% y-o-y to RMB65.2 million ($11.8 million).

Meanwhile, it maintains a “robust” balance sheet with net cash of RMB183 million, equivalent to 60% of its market capitalisation. — The Edge Singapore