DBS Group Research is initiating coverage on the counter with a target price of 35 cents, representing a potential upside of 40% from its last traded price of 25 cents on Jan 14.

In a Jan 15 report, analyst Ling Lee Keng says a re-rating could be on the horizon for the group in the coming year.

For one, Ling notes that Fu Yu has manufacturing facilities in China, Malaysia and Singapore – all of which are slated to experience a turnaround in their respective manufacturing sectors.

“We believe that this will lead to an uptick in earnings for Fu Yu,” says Ling, adding that the three countries’ purchasing manager index (PMI) figures have improved significantly.

China’s PMI had come in at above 50.0 points after six consecutive months of contraction, while year-on-year percentage change in the plastic production volume turned positive in May last year following 16 consecutive months of negative growth.

Likewise, PMI figures in both Malaysia and Singapore had picked up after six and 14 months of contraction respectively.

“With the bottoming out of the manufacturing PMIs, we are positive that the negative growth in these regions will reverse in FY2020 (ending December 2020),” says Ling.

Secondly, Ling hones in on the group’s recent shift in product mix which entails a greater focus on products with higher profitability and growth potential. These include consumer, medical and automotive products.

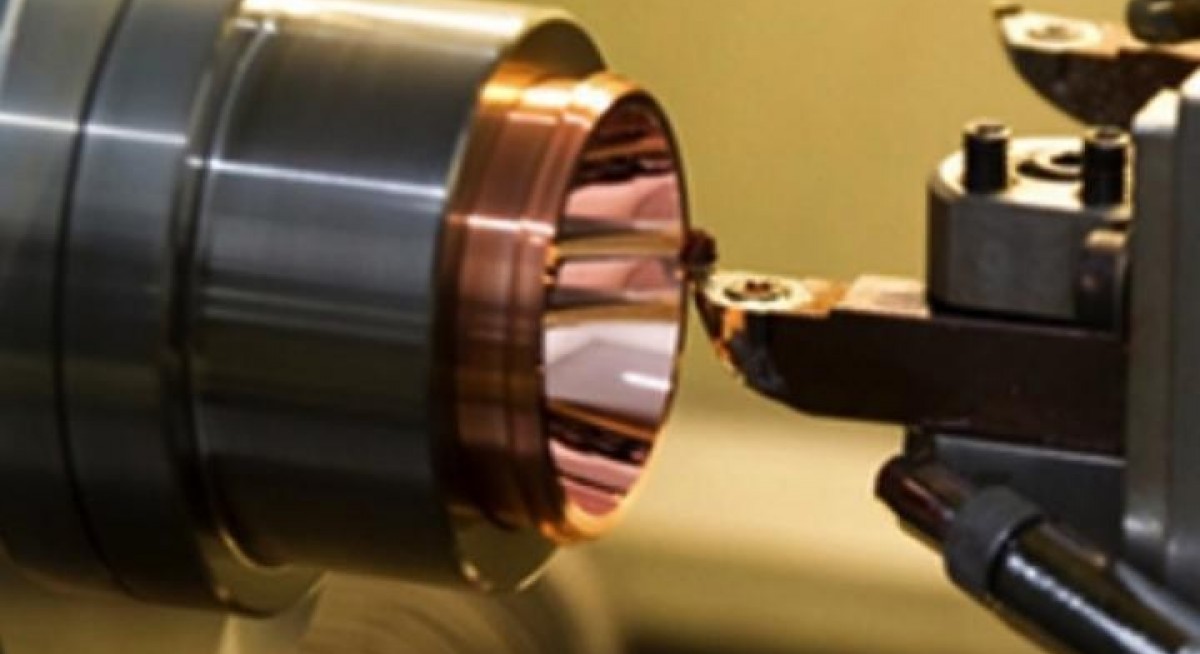

“Fu Yu, which produces plastic parts via injection moulding, is focusing on products with longer life cycles and higher growth potential,” says Ling.

“These products generally command higher margins due to the high-quality design specifications and higher demand, as compared to products in other segments like the printing and imaging division.” Apart from delivering higher returns, these segments are also projected to grow at a faster rate, or high single digits, compared to the plastic manufacturing industry growth of less than 5%.

Besides the shift in focus, Fu Yu is also looking to expand its margins through cost enhancement initiatives. For example, Ling notes that the group is redeveloping its factory in Singapore to improve productivity and efficiency.

Ling also notes that Fu Yu has had an increase in productivity amid initiatives to optimise its production processes through lean management and automation. For instance, the non-executive employee count had declined by 8.5% from 2016 to 2018, while the revenue generated per non-executive employee increased by 8.9% during the same period.

In addition, Ling opines that Fu Yu’s “strong financial positioning” – in terms of its high cash position and absence of borrowings – is noteworthy.

“The current recovery of the manufacturing cycle across its operating regions, as well as its business strategies, presents an opportunity for a re-rating of the stock’s forward price-to-earnings (PE),” adds Ling.— By Uma Devi

Venture Corporation

Price targets:

$16.88 HOLD (CGS-CIMB Research)

$17.00 OUTPERFORM (Macquarie Global Research)

$17.18 ACCUMULATE (Phillip Securities Research)

$16.30 NEUTRAL (RHB Group Research)

Venture Corp’s performance this year could be dragged by a disappointing FY20 revenue guidance by its major customer, US biotechnology equipment manufacturer Illumina, according to CGS-CIMB Research.

CGS-CIMB notes that Illumina’s CEO recently guided that the latter’s revenue could grow 9% to 11% y-o-y, which is below analysts’ expectation of 12%.

The slower growth is due to lower shipments of genome sequencing equipment NovaSeq, Illumina guided.

Still, CGS-CIMB notes that Illumina intends to launch new products this year.

On the broader front, CGS-CIMB believes that the supply chain diversion – as a result of the trade tensions between the US and China – currently presents few benefits to Venture.

The brokerage explains that the revenue contribution arising from the production diversion will take some time to grow in “significance”, owing to delays in corporate decision-making by customers.

For now, CGS-CIMB expects Venture to report lower earnings of $85.5 million for 4QFY2019 ended December 2019, down 20.6% y-o-y.

This will lower the brokerage’s full-year earnings forecast for Venture to $352.4 million, down 4.8% y-o-y from earnings of $370.2 million a year ago.

CGS-CIMB expects Venture to declare a final dividend per share of 50 cents.

“Upside risks are successful new product launches by its customers, while slower orders from customers are a key downside risk,” CGSCIMB analyst William Tng writes in a note dated Jan 14.— By Jeffrey Tan

AEM Holdings

Price targets:

$2.57 OUTPERFORM (KGI Securities Research)

$2.38 ADD (CGS-CIMB Research)

$2.58 BUY (Maybank Kim Eng Research)

$2.38 BUY (DBS Group Research)

There is no slowing down for precision engineering services firm AEM Holdings, as a solid FY2019 ended December 2019 seems to have paved the way for an even better year to come.

On Jan 8, the group announced that it had bagged some $245 million worth of sales orders for delivery in FY2020 ending Dec 31, 2020.

“The group expects FY2020 revenue to be between $330 million to $350 million,” the group said in a regulatory filing on Jan 8.

The revenue guidance appears to have been a sweet surprise to market watchers.

AEM is set to surpass Maybank Kim Eng Research’s forecast by 4-11%, and KGI Securities’ forecast by 12-19%.

Accordingly, Maybank has raised its FY2020 earnings forecast for AEM by 11-16%, while KGI has raised its forecast by 22%.

According to Maybank analyst Lai Gene Lih, a key driver to the group’s improved financial metrics is the sustained momentum from its key customer – semiconductor manufacturer Intel.

Intel’s new business strategy and push into artificial intelligence solutions is expected to continue to drive demand for products such as high density test handlers (HDMT).

“Depending on Intel’s success rate in new markets, this could translate to expanded HDMT wallet size over time. As each new chip tested requires a customised kit, we believe AEM will continually be plugged into Intel’s R&D roadmap,” says Lai in a Jan 15.

In addition, Lai notes that AEM will be commercialising a new hybrid test handler for Intel to test its chips in 2020.

On the flipside, KGI analyst Kenny Tan remains cautiously optimistic. “Intel’s shift came at an awkward timing as they have been receiving substantial flak for their recent underperformance,” Tan explains.

“We acknowledge that AEM stands to benefit from this business pivot, which will support steady sales of test handlers and its peripherals,” he adds.

Apart from its key customer, AEM’s new acquisition of French semiconductor test solutions provider Mu-TEST appears to have ticked all the right boxes for the group, allowing it to extend its solutions offerings.

On the back of a sanguine outlook, both brokerages are maintaining their “buy” calls on AEM.

Maybank has raised its target price to $2.58 from the previous $2.12, while GI has raised its target price to $2.57 from the previous $1.80. — By Uma Devi