A steady operation

See also: A rejuvenated Singapore market, a reset for The Edge Singapore

Data centres lead the charge

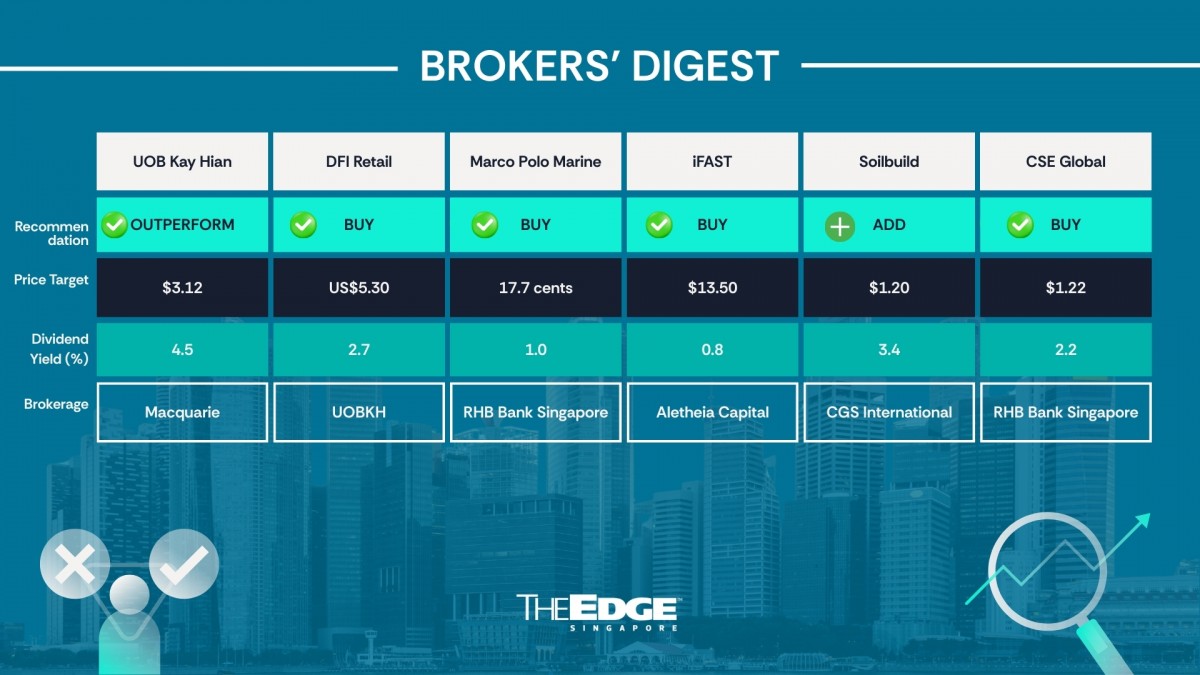

Nowhere are those trends more visible than in CSE Global’s electrification business. The company has quietly emerged as a key systems integrator for the booming data centre market, particularly in the US, where it has secured multiple large-scale power management projects. “Growth in this segment continues to be driven by strong demand from the data centre and utility markets, particularly in the US,” says Lim. “One of our contract wins this year includes major contract variations worth US$46 million [$59.3 million] covering design, engineering, fabrication, installation, and integration of power-management systems.”See also: From momentum to transformation: Building a relevant stock market