A partial view of the sponge facilities under CEW’s Jiangsu Zhenjiang Sponge City Construction Project / Photo: CEW

Holding ground in a competitive industry

A partial view of the sponge facilities under CEW’s Jiangsu Zhenjiang Sponge City Construction Project / Photo: CEW

Holding ground in a competitive industry

See also: A rejuvenated Singapore market, a reset for The Edge Singapore

See also: From momentum to transformation: Building a relevant stock market

Hebei Region, Yangtze River Delta, and Guangdong-Hong Kong-Macau Greater Bay Area, as well as urban renewal plans of key markets. CEW is also monitoring high-quality acquisition opportunities in China.

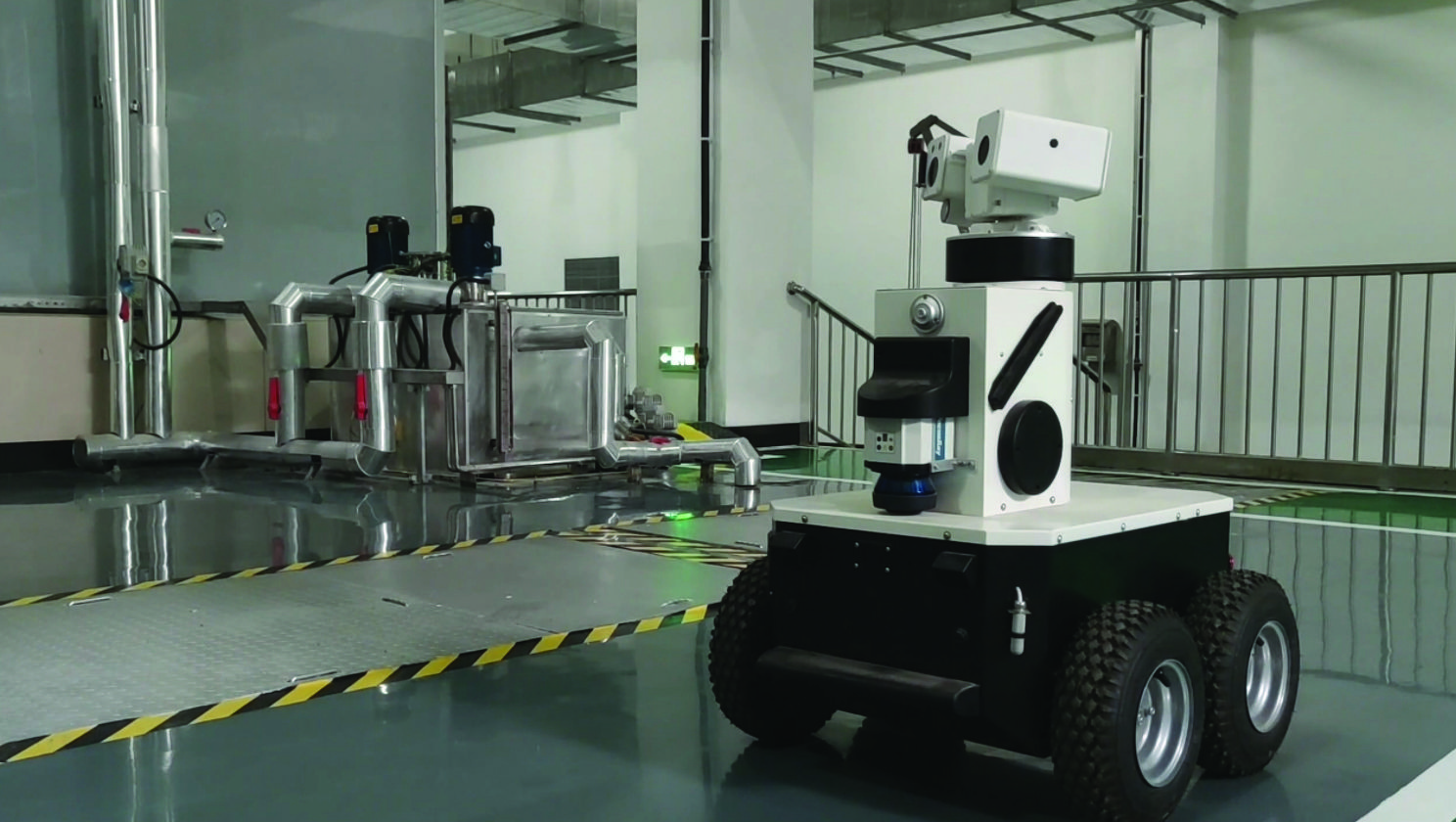

Inspection robots at CEW’s Waste Water Treatment Project / Photo: CEW

Promoting an asset-light model

Inspection robots at CEW’s Waste Water Treatment Project / Photo: CEW

Promoting an asset-light model

Strength through balance

CEW’s strength lies in maintaining balance and prudence amid constant change.

“We are not pursuing growth for its own sake,” Xiong notes. “Our priority is to manage capital carefully, strengthen operations, and ensure every project creates sustainable value. In the current environment, resilience is more important than expansion.”

Over the past three years, the company’s return on equity (ROE) has consistently exceeded 8%, even as its stock trades at about half the industry’s average P/E and around 70% of the average P/B, suggesting its fundamentals and resilience are yet to be fully reflected in its valuation.

According to Xiong, in the next phase, CEW will continue to maintain self-discipline and focus, steadily improve business quality and reduce cost, and strengthen governance practices. In this business, success is measured in decades — not quarters. The company’s pursuit is not only about short-term performance, but also about the ability to navigate cycles and create sustainable value for all its stakeholders.

Strength through balance

CEW’s strength lies in maintaining balance and prudence amid constant change.

“We are not pursuing growth for its own sake,” Xiong notes. “Our priority is to manage capital carefully, strengthen operations, and ensure every project creates sustainable value. In the current environment, resilience is more important than expansion.”

Over the past three years, the company’s return on equity (ROE) has consistently exceeded 8%, even as its stock trades at about half the industry’s average P/E and around 70% of the average P/B, suggesting its fundamentals and resilience are yet to be fully reflected in its valuation.

According to Xiong, in the next phase, CEW will continue to maintain self-discipline and focus, steadily improve business quality and reduce cost, and strengthen governance practices. In this business, success is measured in decades — not quarters. The company’s pursuit is not only about short-term performance, but also about the ability to navigate cycles and create sustainable value for all its stakeholders.

.jpg)