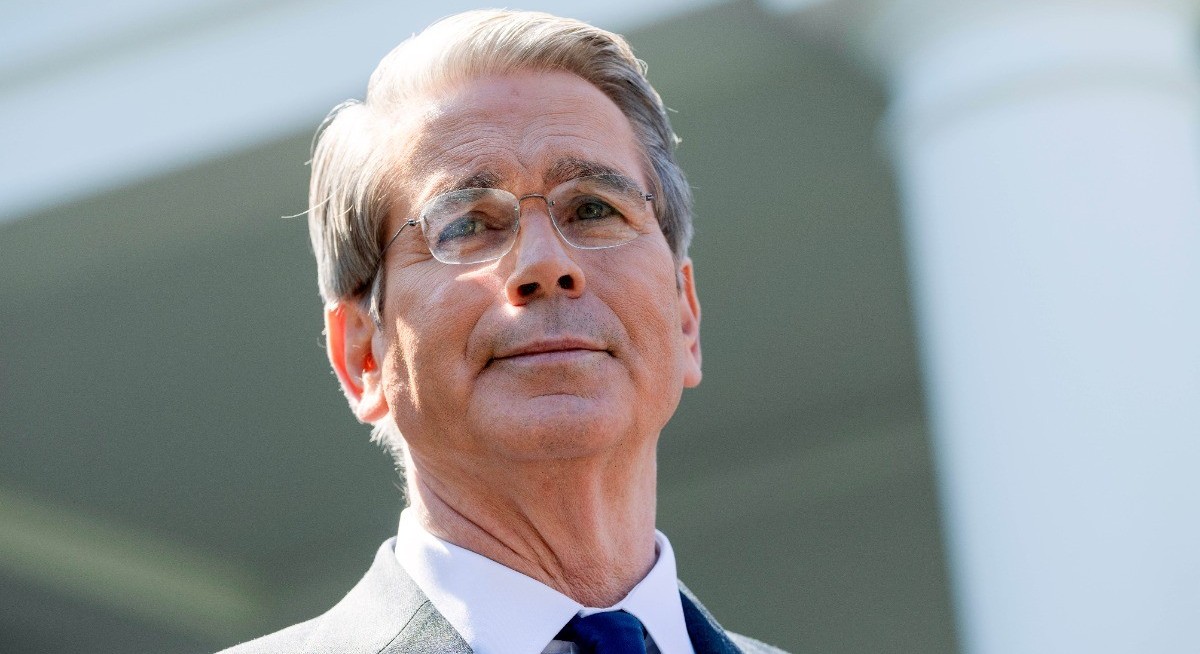

The discussion could potentially be framed around a switch to 1.5% to 2.5% or 1% to 3%, Bessent suggested in the interview, which was posted on Dec 22. “There is a very robust conversation” to be had, he said.

Fed policymakers in 2012 formally and publicly adopted the current 2% target, which is shared by many central banks around the world. Bessent said that the idea of “decimal-point certainty is just absurd”. But he said shifting the target at a time when inflation is running faster than that would risk giving the impression that “when you are above a level, you will always fudge upwards”.

The interview was recorded after the Dec 18 release of the November consumer price index (CPI), which showed a 2.7% increase in the level from a year before. The Fed uses a separate gauge, the so-called personal consumption expenditures (PCE) price index. The PCE climbed 2.8% over the 12 months to September, the most recent reading showed.

People ‘hurting’

See also: Investors pour another US$4 bil into US high-grade bond funds

“It’s very difficult to re-anchor until you meet the target and maintain credibility,” Bessent said. He also acknowledged affordability concerns among households — angst that surfaced in off-cycle elections held in November that saw Republican losses.

The Treasury chief said that “we understand that the American people are hurting”. The price level “has gotten very high”, he said, blaming that surge on the Biden administration. Inflation is now “starting to roll down”, thanks in part to declines in rents that had — he argued — been driven up by a jump in undocumented immigrants.

While some economists said the most recent CPI report likely contained measurement issues thanks to federal staff being furloughed during the government shutdown of October and early November, Bessent said he thought “it was a pretty accurate number”. He said while some components, including energy, recorded an increase, observable real-time figures showed they are coming down.

See also: US home resales fall most in four years despite lower rates

Bessent also indicated that stabilising the budget deficit could provide an argument for lower interest-rate levels. He cited an example from Germany before the days of the euro, where the Bundesbank agreed to “foam the runway” and decrease rates in return for the government pursuing a not-profligate “reasonable fiscal balance”.

German model

“That’s something that we could be doing here,” he said. Germany’s central bank and government “would work with each other hand-in-hand”, he said. He also noted that, before World War II, the Treasury Department “had a seat at the table on the Fed”.

The Treasury secretary said, “If we can stabilise the budget deficit, even bring it down, then that will contribute to disinflation.”

Bessent, who has been overseeing the process for US President Donald Trump selecting a candidate to succeed Fed chair Jerome Powell, reiterated his criticism of the US central bank expanding its balance sheet too much and too long after Covid hit.

“Absolutely, large-scale asset purchases should be part of the so-called central bank toolkit,” he said. He also supported the Fed’s emergency powers to aid a strategic industry if needed, saying “it would not have behooved anyone” for the airline industry to collapse during Covid. As for the broader so-called quantitative initiative, “I think that the duration went on much, much too long”.

Uploaded by Tham Yek Lee