High-profile firms that are still essential to the nuts-and-bolts requirements of AI are likely to see their stocks bounce back after some cooling off. But they could start sharing the spotlight as focus progresses from training of large language models to everyday application of the technology — as well as how to bring down the costs.

“The market is pricing in a new narrative, a new paradigm, which is: what if the dominant LLM isn’t just OpenAI? And that’s why everything is happening,” said Andy Wong, head of multi-asset investment at Pictet Asset Management in Hong Kong. “You need to digest what’s going on, recalibrate, and then apply a new risk premium.”

The chain reaction was set off last month with Alphabet Inc’s launch of an upgraded Gemini model and its reported deals with other firms for its in-house AI chips. Amazon.com Inc’s latest accelerator added to the shift away from AI stock trades that had concentrated on OpenAI and dominant semiconductor firm Nvidia Corp.

See also: OpenAI debuts first model using chips from Nvidia rival Cerebras

Japan’s SoftBank Group Corp, seen as a proxy for OpenAI given the close ties between the two companies, saw its stock slump 38% in November to cap its worst month in 25 years. Shares of Nvidia’s key foundry TSMC and memory provider SK Hynix fell 4% each last month, letting some steam out of their big rallies.

While ChatGPT is being threatened by a growing host of competitors, Nvidia’s AI training processors are losing market attention as application-specific integrated circuits come more to the fore. With that, investors are becoming concerned about negative implications for product pricing.

If LLMs become commoditised, “the ones with cheaper costs will become the winner”, said Han Sangkyoon, chief investment officer at Quad Investment Management in Seoul. He expects the next six months to be crucial in “how the bubble created by Nvidia and OpenAI could burst”.

See also: GIC-backed OpenAI rival Anthropic finalises US$30 bil funding at US$380 bil value

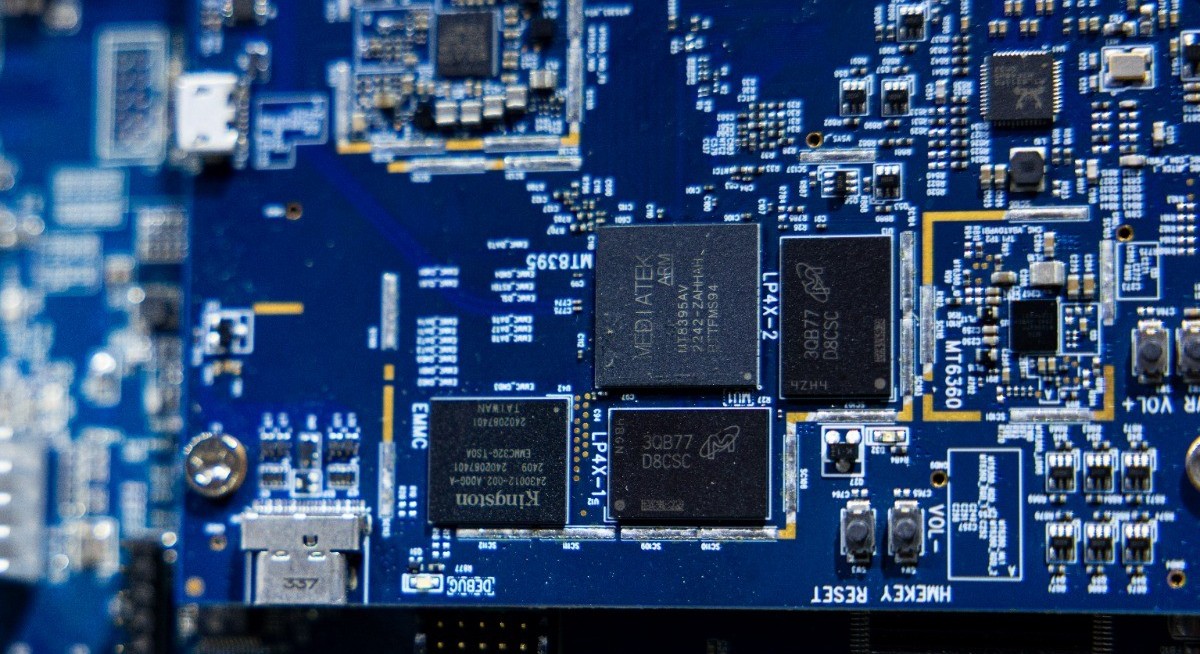

Rather than completely abandon the AI trade, investors are moving to other stocks. MediaTek, a Taiwan-based chip designer working with Alphabet, logged its best week since 2002 following the Gemini debut. South Korea’s IsuPetasys Co, which supplies printed circuit boards for Alphabet, climbed 18% to a fresh record high last week.

Such moves highlight how, regardless of the ultimate brand name or which US megacap sits at the top of the supply chain, there is a string of Asian suppliers that can reap rewards.

“Around 90% of the hardware manufactured globally, which is fitting into data centres — servers, testing environment, anything you need from manufacturing the chips, memory cards, or even testing, cooling systems — all comes from Taiwan, Korea, Japan, Thailand, and even mainland China,” said Egon Vavrek, head of emerging markets and Asia equities at BlackRock Inc.

While the US and China are competing in the AI arms race, their supply chains are still somewhat dependent on each other. Shandong-based optical transceiver maker Zhongji revenue, for example, gets 22% of its revenue from Alphabet and 11% from Amazon. Its stock rose 11% last week to a new peak.

Not that the established leaders of the AI boom are done. TSMC has the most advanced chipmaking technology and provides outsourced manufacturing for all the major players. It’s shares are still poised for a third-straight year of gains that has taken its market value to more than US$1 trillion.

SK Hynix and Samsung Electronics Co together account for over 90% of global market share in the high-bandwidth memory that is another essential component of AI technology, according to research from Macquarie Group Ltd.

To stay ahead of Singapore and the region’s corporate and economic trends, click here for Latest Section

Even as SK Hynix shares have more than tripled this year, bearish hedges have dropped. Short interest in the stock has fallen to 0.6% of its free float from more than 3% in May, according to data from S&P Global Inc.

Investors are always looking for new ideas though, whether due to newsflow, nervousness over valuations of outperformers, or even constraints on holdings in their portfolios.

“AI remains front and centre of tech investors’ minds, even after three years into the theme,” said Timothy Fung, head of Asia equity strategy at JPMorgan Private Bank in Hong Kong. “Opportunities are evolving across the AI supply chain, but remain linked to physical infrastructure.”

Uploaded by Chng Shear Lane