(Nov 14): The US and China are still negotiating over the key details of how Beijing will free up sales of rare earths, according to a person familiar with the matter, weeks after a trade truce that Washington said would pave the way for increased exports.

The two sides have given their teams until the end of November to agree on terms for “general licences” that China pledged to offer for US-bound exports of rare earths and other critical minerals, said the person, who declined to give a reason for the delay.

The White House listed the commitment in its account of the agreement reached between President Donald Trump and his Chinese counterpart Xi Jinping two weeks ago. The US characterised the move as the “de facto removal” of various curbs imposed since 2023, and touted it a major win for the global economy and supply chains.

But while Washington has already rolled back tariffs and paused a number of national security measures as part of the agreement, China has yet to comment on the licensing pledge. Beijing has confirmed other aspects of the truce, including a one-year pause on extra rare-earth controls announced only weeks before the talks in South Korea.

The lack of clarity has left rare-earth exporters in limbo. Several have said they are still awaiting fresh guidance and had yet to see a change in practices on the ground.

“My sense is that everyone is still in wait-and-see mode on how the general licence process will unfold,” said Christopher Beddor, deputy China research director at Gavekal Dragonomics. “Both sides have framed the agreement quite differently, but it would be genuinely surprising if they walked away again with a fundamentally different understanding of the deal.”

See also: The geopolitical risk illusion: Why ‘forecasting geopolitics’ is poor risk management

The White House did not immediately respond to a request for comment. China’s Ministry of Commerce also did not immediately respond to queries.

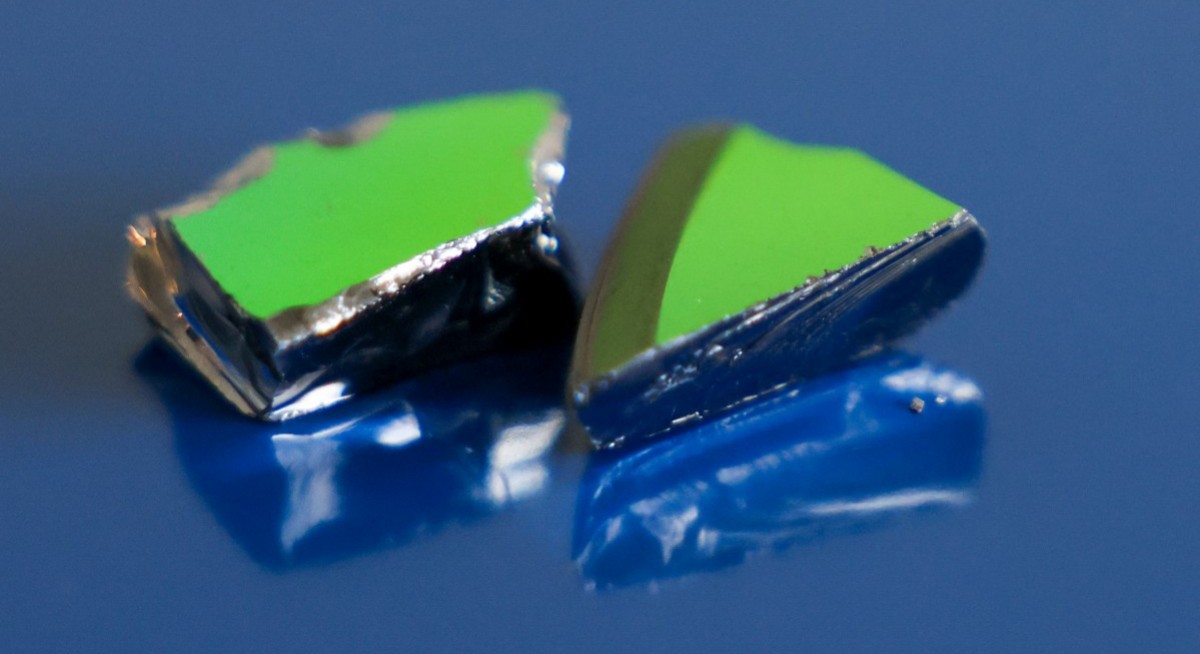

Shortfalls in supplies of rare-earth magnets this year had left global industries from carmaking to consumer goods and robotics at risk of production disruptions. China’s tightening grip on the inputs has dictated trade talks between the world’s two biggest economies since April, effectively giving Beijing the upper hand.

The “general licence” is an existing provision in China’s law on dual-use export controls, allowing for multiple shipments of controlled items over a period of time — up to three years — to one or more designated buyers. That’s different from the standard controls applied to rare earths this year that demand individual approval for each shipment.

See also: Japan, US to join forces to mine rare earths near Pacific Island

But the regulations for the more generous licences still require official vetting of the purchasers, and the parties should also have a strong track record of one-time approvals under the export control regime.

According to the White House fact sheet on the trade truce, general licences will be issued for rare earths and for other materials subject to Chinese export controls since 2023. That covers metals including gallium, germanium, antimony, tungsten and graphite, as well as the restricted rare earths. Beijing confirmed it would lift an outright ban on direct shipments to the US for the first three.

Uploaded by Felyx Teoh