(Nov 4): Top executives at Western brands that do business in China are showing cautious optimism that consumer spending in the crucial market is starting to recover after a lengthy downturn.

“There’s some momentum building,” Estée Lauder CEO Stéphane de La Faverie said in an interview with Bloomberg. “The market is starting to accelerate.”

De La Faverie has flown to China three times this year to work on this vital business unit, which sells brands such as La Mer, Tom Ford Beauty and Le Labo in the region. He’s ramping up the use of its research and development lab in Shanghai and opening more pop-up shops in the tourism hub of Hainan, where foot traffic to stores has surged past pre-Covid-19 levels.

But he’s still reluctant to declare a full comeback: “There is still some caution on China.”

Several North American and European companies have posted positive results in China in recent weeks. In beauty, Estée Lauder’s organic net sales in the region rose 9% last quarter and L’Oréal SA’s sales were up 3%. Luxury goods giant LVMH reported that China contributed to its growth in Asia, citing its fashion lines and leather goods. In footwear, Adidas AG posted double-digit growth and Crocs Inc’s sales there spiked in the mid-20%.

The brands are growing from a low base in 2024. China has been mired in its longest streak of economy-wide price declines since market reforms in the late 1970s, with a housing market crash compounding slowing consumption on the back of the fading impact of the government’s subsidies to boost demand.

See also: China’s MSCI presence expands for first time in nearly two years

Both high-end and mass-market retailers in China have suffered from sales slumps in categories spanning skincare to handbags and beer. Meanwhile, price wars and promotional campaigns have intensified despite regulatory calls to eliminate unfair competition.

Beijing pledged to significantly boost consumption in its economy in the next five years as a way to become less reliant on exports. But it’s a tough task amid job market uncertainties and a lingering real estate crisis.

‘Still weak’

See also: AI veteran from Tencent snags funds for year-old rival to OpenAI's Sora

“It remains to be seen whether this recovery will be sustainable,” said Michelle Cheng, co-head of Asia Consumer Research at Goldman Sachs. “Any wealth effect that could meaningfully boost Chinese consumers’ sentiment would still fundamentally rely on the property market and this sector is still weak.”

While executives at some of the world’s biggest consumer goods companies are more bullish on China, they warn that any long-term recovery remains in its early stages.

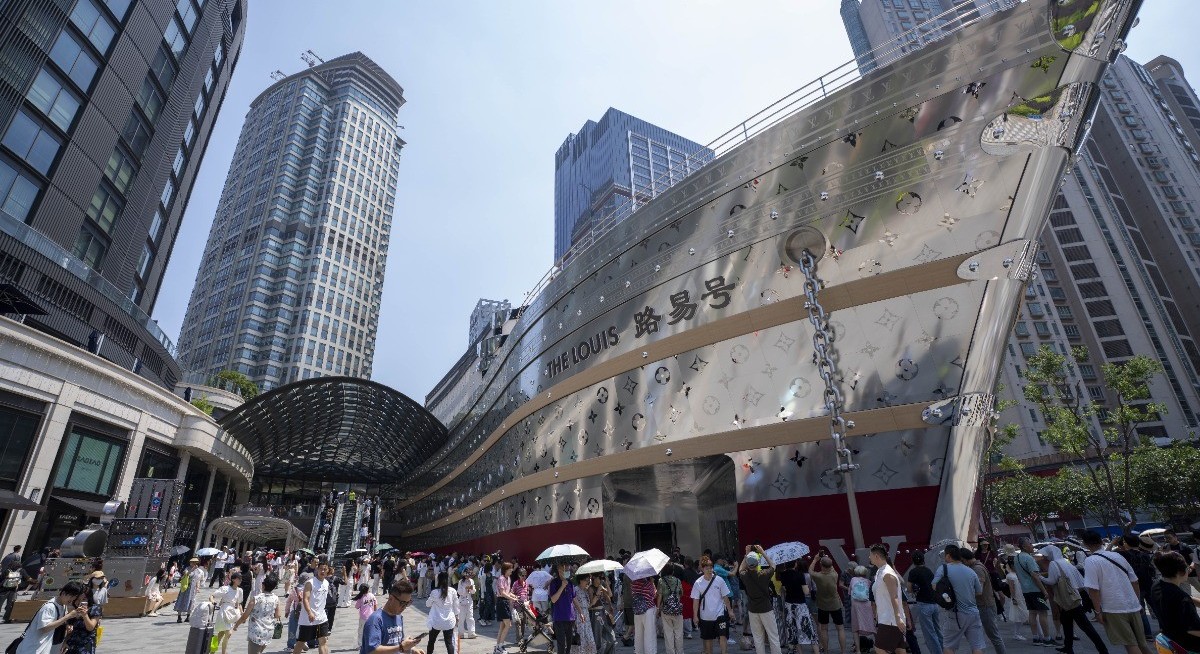

LVMH executives told investors in October that all their brands have made progress in China, especially Louis Vuitton, which recently opened an enormous flagship store with a restaurant and artistic exhibition in Shanghai.

“It’s true that we have been having very steep improvement for Vuitton,” LVMH chief financial officer Cécile Cabanis said on a call with analysts. “We consider it’s still going to take time until we have a rebound on China as a whole.”

At Adidas, CEO Bjørn Gulden told investors that he’s thrilled about his company’s position in China, where the sportswear brand has been pushing products like basketball shoes.

L’Oréal CEO Nicolas Hieronimus warned investors not to get overexcited but said that he’s seen a “slight uptick in consumer confidence” in China and that the market has stabilised. L’Oréal, which sells a wide range of brands such as Maybelline and Lancôme in China, saw gains across its channels — especially luxury.

“I’m always very careful about China,” Hieronimus said. “But overall, the market has gone into positive territory.”