Amid tame inflation and risks to economic growth from global uncertainties, the central bank has previously signalled that it will likely further lower its key policy rate this year, after 125 basis points in cumulative reductions since August 2024. The latest cut came last month, bringing the overnight target reverse repurchase rate to 5.25%, the lowest in nearly three years.

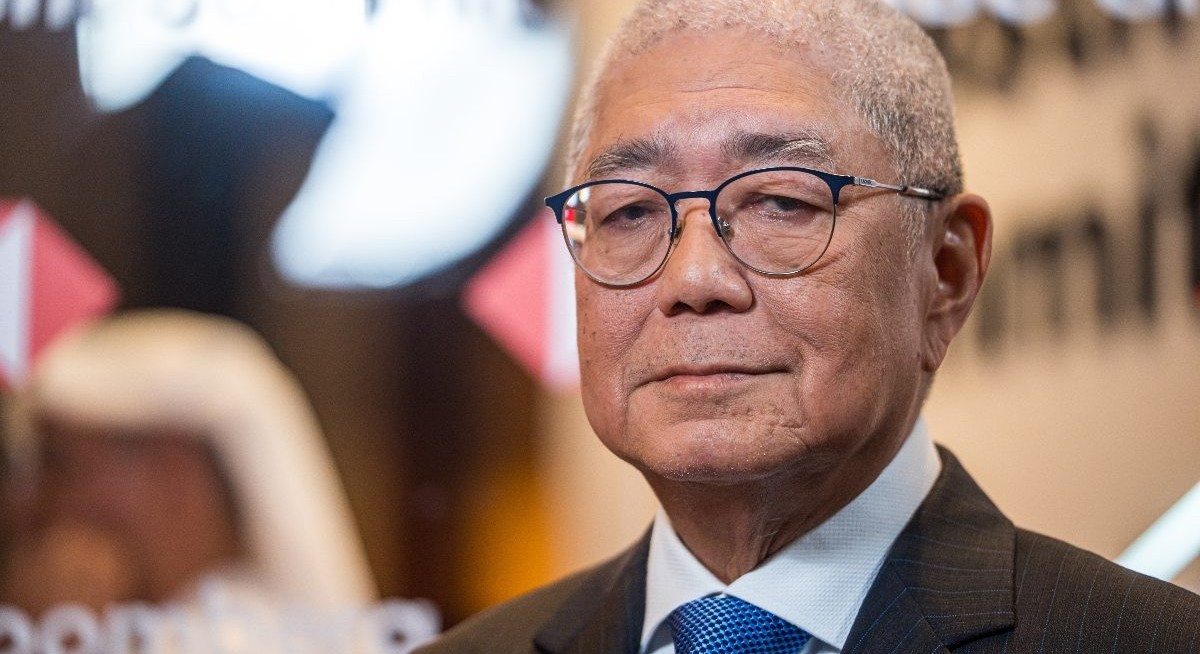

There’s now greater clarity in the global tariff situation, according to Remolona. “It’s much clearer now than before,” he said. President Donald Trump imposed a 19% tariff on Philippine goods after meeting with President Ferdinand Marcos Jr. at the White House last week.

That’s marginally lower than the 20% rate that the Trump administration announced for the Philippines earlier this month, and puts it at par with Indonesia.

The central bank chief said the 19% tariff is expected to have a “modest” impact on the local economy.

See also: Thai assets rally as election victory signals policy continuity

The government has lowered its 2025 inflation assumption to 2%-3%, providing a favourable backdrop for a further reduction in borrowing costs, although the BSP has said it’s sticking to its target of 2%-4% for now. July inflation data are set to be released on Aug. 5.

Further monetary easing will help support the Southeast Asian economy, after the government cut its growth outlook for this year on lingering trade risks from Trump’s tariff policies.

The Philippine peso closed at 57.31 against the dollar, declining for a third day with the greenback bolstered by a long-awaited trade deal between the US and the European Union. The peso, however, remains well above its record-low of 59, giving the BSP leeway in continuing its easing cycle.