While headline metrics like declining housing starts, building permits and office construction may paint a narrative of a distressed construction market, total construction spending in the US has in fact grown at a steady compound rate of 9% per annum since 2020. This was, in large part, driven by increased spending on computer and electrical and electronics manufacturing, fuelled by US$1.25 trillion of capital injection from the Infrastructure Investment and Jobs Act (IIJA) and CHIPS and Science Act. Going forward, we expect accelerated reshoring of manufacturing activities and the gradual reduced reliance on global supply chains as well as rebuilding of ageing infrastructure to underpin demand growth. And we think US steel companies will be one of the main beneficiaries, initially from higher prices (25% tariffs on all steel imports) and more importantly, from sustained demand over the longer term.

Investment thesis: Steel sector will be one of the main beneficiaries of US reindustrialisation

See also: Time for Malaysia to pivot from manufacturing to services

To be sure, the US steel industry has performed abysmally in recent years, caught between sluggish demand, falling prices and low utilisation rates. After reaching post-pandemic stimulus highs in 2021, steel prices have been on a downward trend. Prices have been under pressure from weak automotive market demand — the industry’s second-largest single customer — combined with China’s excess capacity and cheap exports into the global market. China, the world’s largest producer and consumer of steel, is grappling with the collapse of its domestic residential property sector and falling steel demand. Chinese steel producers have been exporting their excess capacity to the rest of the world. This is the reason why an increasing number of countries have imposed anti-dumping duties on Chinese steel products to protect domestic producers. Given that most steel mills need to maintain a minimum utilisation rate to cover fixed overheads, continued production has contributed to the worsening oversupply situation. Combined, these factors led to severe margin compression and industry-wide underperformance.

Trump has implemented new tariffs of 25% on all steel and aluminium imports effective March 12, 2025 — with no exemption for any country. Additionally, steel imports from Mexico and Canada — two of the three largest steel exporters to the US last year — will be taxed at a higher rate of 50% due to the existence of separate targeted 25% tariffs on all imports from both countries (the tariffs are additive).

Historically, imports have accounted for approximately a quarter of the US steel market (23% in 2024), of which more than half consists of commodity-grade steel. Given the high price elasticity of these commoditised products, buyers will pivot toward now “cheaper” domestic production. That gives US steel producers the advantage to raise selling prices, in response to the tariffs. Case in point, Nucor Corp, the largest steel producer in the US, announced its eighth consecutive price increase for hot-rolled coil (HRC) products. US HRC prices — the benchmark for steel prices — have jumped more than 30% since the start of the year, from US$717 per ton to the current US$937 per ton. Higher selling prices will generate much-needed additional cash flow for steel producers in the country.

See also: Markets rise when merit is recognised

Back in 2018, HRC prices rose 33% to US$915 per tonne over six months following the implementation of the original Trump tariff. In that instance, prices collapsed again soon after, as many country- and/or product-specific exemptions were subsequently given out, including to Canada and Mexico. Unlike during his first term in office, this time around, Trump has indicated that no exemption will be offered. And with demand supported by increased spending in the construction and infrastructure sectors, we think steel prices should be stickier.

In summary, with the expected rising demand from construction activities and prices supported by tariffs, we believe the US steel industry is finally poised for a more sustainable recovery after a prolonged period of stagnation. This is why we added two steel stocks to the Absolute Returns Portfolio — Nucor Corp and US Steel. We think there would be greater short-term catalysts for US Steel while Nucor offers better exposure for the longer term.

Nucor

Nucor is the largest steel producer in the US by volume, holding an approximate market share of 13%, and has a market capitalisation of nearly US$30 billion. It is also the largest scrap metal recycler through its subsidiary, The David J Joseph Co (DJJ). Operationally, the company is divided into three vertically integrated segments: raw materials (DJJ); steel mills — the largest contributor, approximately 57% of revenue in 2024; and steel products. Nucor’s steel mills operate exclusively using the electric arc furnace (EAF) technology (as opposed to blast furnaces). The distinction here is an important one, with implications across the value chain, cost structure and operational efficiency.

Traditional blast furnaces use iron ore as the primary feedstock and have higher operating costs as well as inflexible production schedules. However, they produce higher-quality steel that is crucial for the automotive and high-end structural component end-markets. On the other hand, EAFs, or “mini mills”, operate in batches, using scrap steel as the main input and producing steel primarily for the construction and infrastructure industry. The point is: We believe EAF steel producers stand to reap the most direct benefits from nation-building efforts.

In Nucor’s case, construction and infrastructure is its largest end-market by far, contributing 50% of total revenue in 2024. The energy segment (formed in 2022 after the company acquired Summit Utility Structures) specialises in steel poles/structures for power transmission and telecommunication markets. Production capacity will increase once the construction of two automated tower manufacturing plants is completed in 2025, with a third coming online in 2027 (see Chart 3).

For more stories about where money flows, click here for Capital Section

Over the past year, Nucor has experienced a decline in both revenue and net profit, down 11% and 50% respectively on a year-on-year (y-o-y) basis. As with its peers, this was due to the soft demand environment and falling steel prices (that outpaced the drop in scrap metal prices). As a result, the company suffered a 40% y-o-y contraction in operating margin. While these numbers appear bleak, shrinking margins and poor earnings are the typical profile of a cyclical company at the bottom end of its cycle. What this also means is that margins and earnings improvements will be strong when the cycle turns — and we think it is turning around, on the back of both demand and price recovery.

Presently, Nucor is midway through a series of growth-oriented projects — both to expand its steelmaking operations and diversify into higher-value added products. It has spent some US$16 billion in capex since 2020. Over the past year, this has included the strategic acquisitions of garage door manufacturer C.H.I. Overhead Doors and data centre infrastructure supplier Southwest Data Products. Both ventures will expand Nucor’s market reach beyond the traditional steel markets into higher-margin and higher-growth segments. The downstream products should also help to mitigate the risk of margin compression in times of falling scrap and steel prices (which tend to move closely in tandem). Currently, the company’s upstream scrap metal operation (DJJ) already provides some degree of insulation from fluctuations in scrap prices.

We like Nucor for its diversified operations and revenue streams, strong capital management and ability to scale up (absorb additional production capacity). We believe Nucor is best positioned to capitalise on growing demand over the longer term, with the scale and flexibility to ramp up production. As at 2024, Nucor’s total steel production capacity stood at 33 million tons per annum — more than double that of the next largest EAF operator, Steel Dynamics, which has roughly 13 million tons per annum capacity. In 1H2025 alone, Nucor’s production capacity is set to increase by 1.3 million tons across multiple product lines as two new facilities become operational.

Despite spending consistently on capex and the industry’s cyclical nature, Nucor has maintained a strong track record of capital management. Free cash flow remained positive over the past five years, even while the company deployed US$16 billion in expansion projects and returned another US$12 billion to shareholders over the period. Indeed, the company stayed profitable over the last decade, navigating through the ups and downs of the steel sector (see Chart 4). Nucor’s consistent focus on reinvestment and expanding its steelmaking capabilities reinforces its position as the key player in the industry — and we believe it is set to benefit from both nearterm tailwinds and long-term structural trends.

US Steel

US Steel is likely a more familiar name for many investors, if only because of its highly publicised — but ultimately failed — acquisition by Nippon Steel Corp, Japan’s largest steelmaker. For a quick recap, Nippon Steel proposed to acquire US Steel for US$14.9 billion (a big premium to its share price then) in December 2023, driving the latter’s share price sharply higher. Nippon Steel has also promised billions in additional investments to modernise US Steel’s ageing mills. However, its share price has since then fallen back some, as the proposal faced intense scrutiny over national security concerns. It was opposed by the steelworker union (though overwhelmingly approved by its shareholders) and was ultimately blocked by former President Joe Biden. And President Trump has not appeared any more amenable to the deal, though he did indicate support for Nippon Steel to take an investment stake. The deal is now stuck in legal proceedings after both Nippon Steel and US Steel filed lawsuits to challenge the decision. US Steel has a current market capitalisation of around US$9.2 billion.

US Steel’s share price has fared relatively well in recent weeks as it is expected to be one of the biggest immediate beneficiaries of higher steel prices on the back of Trump’s 25% tariffs, due to the nature of its operations, which is heavily focused on steelmaking.

The company’s operations are divided into four main business segments — flat-rolled, USSE (European arm based in Slovakia), mini mills and tubular — but mill operations essentially account for 93% of revenue. This means US Steel has greater potential gains from steel tariffs compared to other more vertically integrated steel operators. As mentioned above, the commodity-grade products make up the largest share of steel imports and are the direct competition to domestic mills.

US Steel operates both blast furnaces and EAFs, although it remains heavily reliant on the former. This is reflected in its more volatile financial performance — net losses in four of the past 10 years. Revenue and net profit declined 13% and 57% y-o-y respectively in 2024. Beyond the operational challenges of predominantly running blast furnaces — where fixed costs are much higher and therefore, suffer the most when demand and prices are low — another key reason for US Steel’s earnings volatility is its significant spot market exposure. For instance, 40% of sales last year was made in the spot market. Hence, its earnings are closely tied to steel price movements — both on the up and downside. Case in point, at the peak of the 2021 steel cycle, US Steel recorded the highest net profit margin of 21% compared with that of major peers Cleveland-Cliffs (15%), Steel Dynamics (17%) and Nucor (19%) (See Chart 5).

Looking ahead, iron ore prices (raw material) are projected to see a modest decline this year, on the back of subdued Chinese demand and disruptions to global trade due to tariffs. Combined with the expected support for steel prices from tariffs and growing demand, US Steel should see a swift turnaround in both operating and net margins, which will be further bolstered by its significant spot market exposure (can quickly capitalise on rising steel prices).

Additionally, with the completion of its Big River 2 facility in 2024, management has indicated no major capex in the foreseeable future. (The new EAF plants, Big River 1 and Big River 2, mark US Steel’s strategic pivot toward modernising its asset base. It is the first steel company worldwide to receive Responsible Steel certification, meeting ESG standards for responsible sourcing and decarbonisation). As a result, capex as a percentage of revenue will likely drop (from double digits previously), which should translate into meaningful improvements to the company’s cash position. Free cash flow, one of its most concerning metrics in recent periods, is currently -US$1.37 billion. But this trend should reverse with improved profitability and lower capex outflows.

Box Article: Explaining the maths behind ‘terming out’

We have written our articles on the basis that our readers are not technical. But we have received many queries on how the “terming out” of UST (US Treasuries) held by central banks around the world as forex reserves helps the US. So, let’s get technical.

- As we said, Trumpianomics is the belief that the US dollar is overvalued and hurting US exports, industries, employment and wages. Reasons include the Triffin Effect of a reserve currency and unfair devaluation of foreign currencies. While the initial remedy is tariffs and deregulations to increase US competitiveness, it is necessary for the US dollar to fall over time to maintain competitiveness.

- Those central banks holding US dollardenominated assets may be asked to sell and buy their own currencies ... plus switch short-duration UST for much, much longer UST (terming out).

- The problem is that if the market expects the US dollar to fall, holders will get out in a hurry — causing a financial crisis and short-term yields for UST to rise — resulting in a fall in asset prices (including the stock and property markets) and an economic slowdown. Why? Holders will demand higher yields to compensate for a fall in capital values (US dollar depreciation).

- The following math will help explain: UST 10-year yield = 4.36%, principal = $1,000, coupon paid semi-annually, Semi-annual rate = 4.36% / 2 = 2.18%; Number of periods = 10 years x 2 = 20;

- As we said, Trumpianomics is the belief that the US dollar is overvalued and hurting US exports, industries, employment and wages. Reasons include the Triffin Effect of a reserve currency and unfair devaluation of foreign currencies. While the initial remedy is tariffs and deregulations to increase US competitiveness, it is necessary for the US dollar to fall over time to maintain competitiveness.

- Those central banks holding US dollardenominated assets may be asked to sell and buy their own currencies ... plus switch short-duration UST for much, much longer UST (terming out).

- The problem is that if the market expects the US dollar to fall, holders will get out in a hurry — causing a financial crisis and short-term yields for UST to rise — resulting in a fall in asset prices (including the stock and property markets) and an economic slowdown. Why? Holders will demand higher yields to compensate for a fall in capital values (US dollar depreciation).

- The following math will help explain: UST 10-year yield = 4.36%, principal = $1,000, coupon paid semi-annually, Semi-annual rate = 4.36% / 2 = 2.18%; Number of periods = 10 years x 2 = 20;

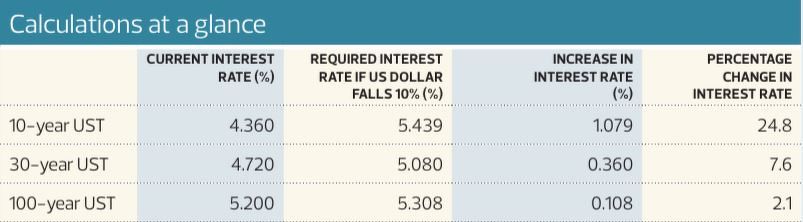

In other words, if the US dollar drops by 10%, to make whole or to preserve purchasing power, the UST 10-year yield must increase from 4.36% to 5.439%. - To understand the effects of “terming out”, let’s now go to 30-year UST. UST 30-year yield = 4.72%, principal = $1,000; coupon paid semi-annually; FV = $4,053.37

Adjusting for a 10% loss in US dollar value,

For the 30-year UST, the interest rate must rise from 4.72% to 5.08% to make up for the 10% fall in US dollar for a foreign holder. - Now, let’s take it one step further for a hypothetical 100-year UST with a yield of 5.2%, principal = $1,000, coupon paid semi-annually. FV = $169,618.08

For 100-year UST, for the same 10% fall in USD value, the compensating rise in interest rate is only from 5.2% to 5.308%. - We think you’re getting it. Let’s put all the above calculations in a table (see Above).

For every percentage devaluation of the US dollar, the rise in interest rates for UST gets smaller the longer the UST is “termed out”, or duration out. If the UST is perpetual, there would effectively be no increase in interest rates because there will mathematically be no future value, with only coupon interest paid semi-annually in perpetuity. Obviously, the longer the tenure of the UST or US debts, the higher is the risk for the holders of US debt or investors. It may require moral suasion by the US/Trump to achieve this objective — and this is tied back to our Part 2: Trumpianomics – The Art of Coercion (The Edge, March 24, 2025).

— End of Box Article —

The Malaysian Portfolio lost 0.8% for the week ended April 2. Insas-C was the only gainer, up by 1 sen to 6 sen per warrant. In view of the growing risks from US President Trump’s just-announced tariffs on economic growth, we reduced our portfolio holdings further. We disposed of all our shares in Kumpulan Kitacon, UOA Development and Harbour-Link Group, raising our cash to almost 80% of the total portfolio value. Total portfolio returns now stand at 184.8%, outperforming the FBM KLCI, which is down 16.6% over the same period, by a long, long way.

The Absolute Returns Portfolio lost 0.7% for the week, paring total returns since inception to 24.8%. The two gaining stocks were SPDR Gold MiniShares (+3.5%) and Berkshire Hathaway (+0.8%) while Crowdstrike closed unchanged. The biggest losers were CRH (-4.2%), Nucor Corp (-3.4%) and JPMorgan Chase (-2.1%).

Disclaimer: This is a personal portfolio for information purposes only and does not constitute a recommendation or solicitation or expression of views to influence readers to buy/sell stocks, including the particular stocks mentioned herein. It does not take into account an individual investor’s particular financial situation, investment objectives, investment horizon, risk profile and/ or risk preference. Our shareholders, directors and employees may have positions in or may be materially interested in any of the stocks. We may also have or have had dealings with or may provide or have provided content services to the companies mentioned in the reports.