Short term stochastics is up and at the top end of its range but it hasn’t turned down yet. That means the STI is unlikely to fall much below 3,500. The 50-day moving average is at 3,442. The break above the sideways range at 3,440, set an initial target of 3,550 which has been attained. This may lead to some consolidation before the next up-wave. The 2007 high was at 3,805.

STI Weekly: an ageing bull

It must be noted that the bull market is ageing. Also, annual momentum continues to struggle, something it has done for the past three months.

See also: Singapore assets remain a safe haven as volatility engulfs bitcoin and gold

Annual momentum may continue to move sideways. The 24-month momentum continues to rise and will be able to move higher till the end of the year, after which it could turn down. The interaction between these two indicators suggests that the STI will stay intact till the second half of the year.

M&A plays Sembcorp Marine ($2.30) sharp surge suggests corporate action The price and volume surge of the past two sessions suggests some sort of M&A, and this comes amidst market mutters that Keppel Corp could be acquiring Sembcorp Marine at either $2.30 or $2.50.

See also: Roundophobia could set in as STI approaches 5,000 but uptrend should stay intact

M&A plays

Sembcorp Marine ($2.30) sharp surge suggests corporate action

The price and volume surge of the past two sessions suggests some sort of M&A, and this comes amidst market mutters that Keppel Corp could be acquiring Sembcorp Marine at either $2.30 or $2.50.

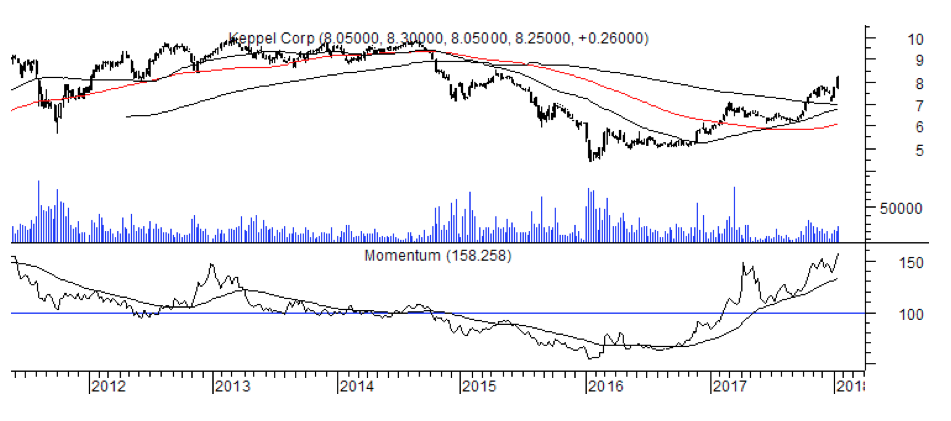

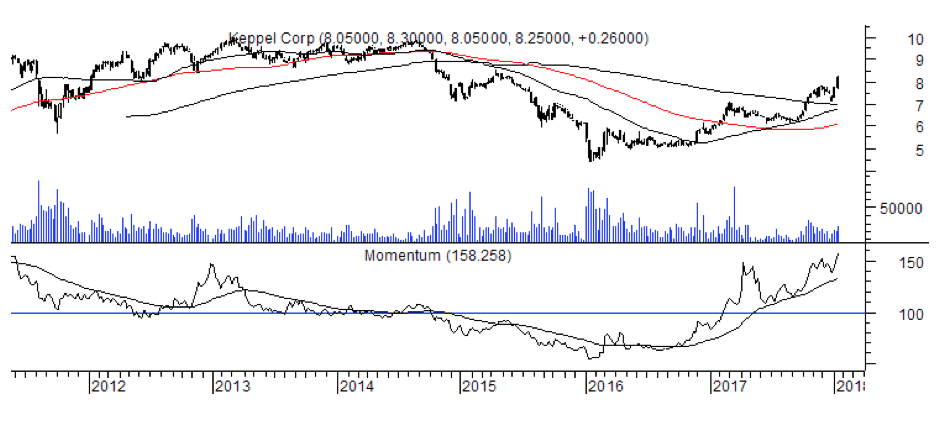

Keppel Corp, Weekly ($8.25) breaks out of two year base Although the acquirer is usually under some pressure in an M&A, this counter has broken out of a two-year base formation that looks like a reverse head-and-shoulder on the weekly chart.

Keppel Corp, Weekly ($8.25) breaks out of two year base

Although the acquirer is usually under some pressure in an M&A, this counter has broken out of a two-year base formation that looks like a reverse head-and-shoulder on the weekly chart.

The breakout indicates an upside of $9.70 initially and $10 subsequently. This is a long term target. In the immediate term, prices could ease somewhat after rising 10.4% since the start of 2018. The new support appears at $7.77.