However, adjusted net profit, after factoring in other gains and losses, one-off items under other income as well as share of profits from associates, surged by 164% y-o-y to $61.7 million. This was due to the better performance and growth seen across Wee Hur’s core business segments, including property development, construction and workers’ dormitories.

Revenue increased by 43% y-o-y to $156.0 million mainly due to a one-off performance and disposal fee from the sale of Fund I to Greystar. The higher revenue was also attributed to the strong performance in the group’s property development business in Singapore.

Revenue for the Singapore property development business grew by 158% y-o-y to $47 million due to progressive revenue recognition from the Bartley Vue project, which achieved “significant construction milestones” during the period. The group also achieved a 100% sales rate for Bartley Vue and a 99% sales rate for its Mega@Woodlands industrial development of 517 strata-titled units.

Revenue for the group’s workers’ dormitory business fell by 2% y-o-y to $42 million due to a slight decline in average occupancy rates. According to the group, Tuas View Dormitory achieved an average occupancy rate of 93% in 1HFY2025 while maintaining its rental rates.

See also: Marco Polo Marine reports revenue of $32.8 mil for 1QFY2026

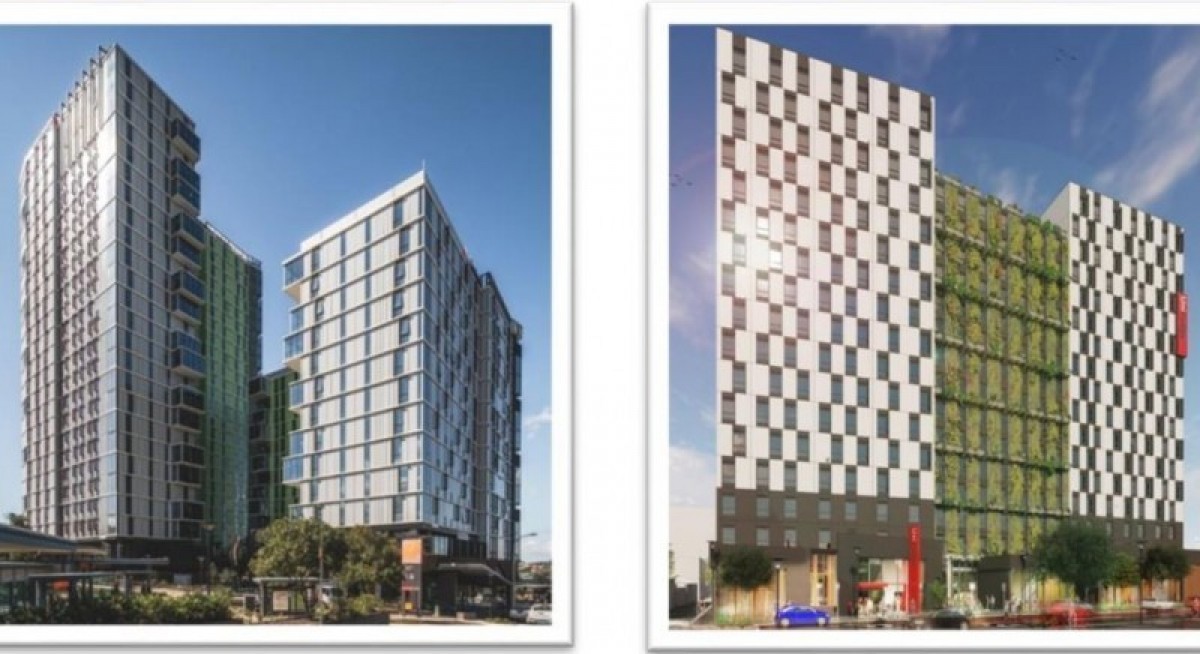

Wee Hur’s PBSA segment incurred a loss of $5.9 million mainly from a a fair value loss resulting from market-driven adjustments. PBSA operations reported stable revenues at $1.0 million from two PBSA properties.

In Australia, Wee Hur says it has received approval for its first greenfield residential subdivision project in SouthEast Queensland, Australia, with 358 housing lots. It adds that it is “positioned for further growth in Australia, leveraging strong local partnerships and an agile land acquisition strategy that allows it to secure sites ahead of other market players”. The group also believes there is “considerable potential” to build a “robust land bank pipeline” to meet the country’s pressing housing needs.

Gross profit increased by 89% y-o-y to $84.3 million as gross profit margin increased by 13.1 percentage points y-o-y to 54.1%.

For the period, the group has declared an interim dividend of 0.5 cents per share, up from the 0.2 cents per share declared in the 1HFY2024. The interim dividend will be paid on Sept 5.

“Our core businesses continued to perform well in the first half of 2025, supported by strong execution and sustained market demand,” says Goh Yeow Lian, executive chairman and managing director of Wee Hur.

“Following the partial disposal of PBSA Fund I and the added funding flexibility from our recently launched medium term note programme, we have a strong financial position that enables us to strategically redeploy capital into our core businesses, driving the group’s growth over the mid to long term,” he adds.

Shares in Wee Hur closed 1 cent lower or 1.45% down at 68 cents on Aug 14.