Meanwhile, gross profit increased 61.1% y-o-y to $5.8 million in 3QFY2025, mainly due to higher revenue achieved in the same period.

Accordingly, gross profit margin for 3QFY2025 increased to 18.7%, which is an improvement of 7 percentage points from 11.7% in 3QFY2024.

Excluding forex losses and one-off professional fees, EBITDA for 3QFY2025 stood at $4.0 million, higher than the figure of $3.0 million in 3QFY2024.

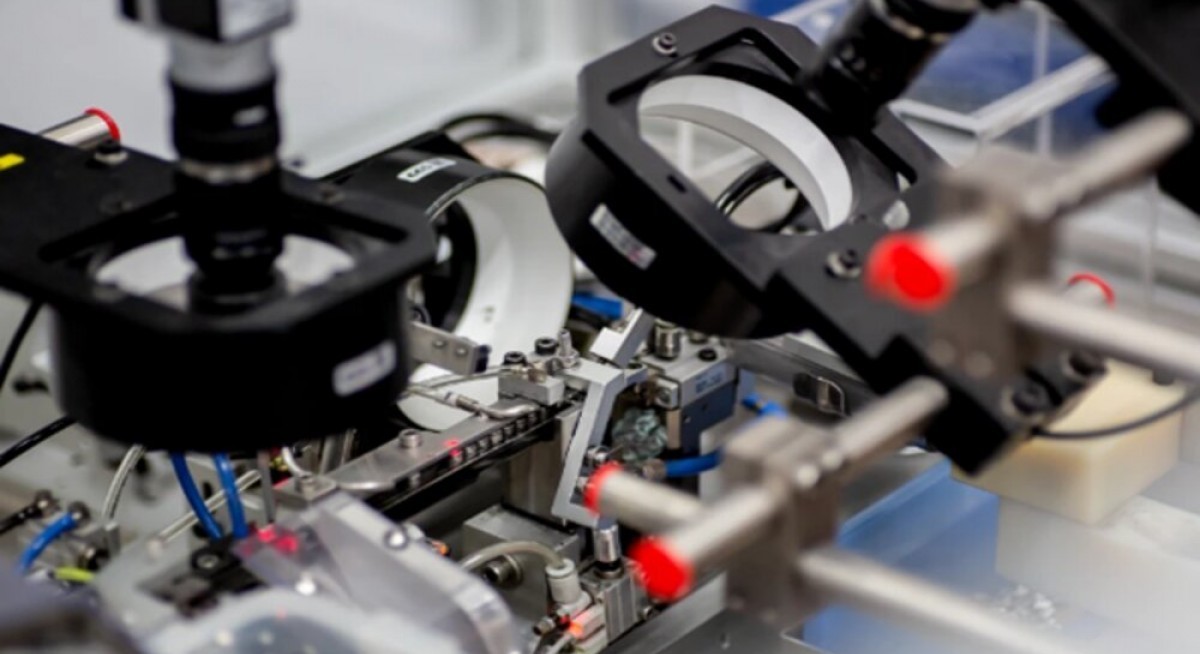

On a 9MFY2025 basis, contributions from the Singapore operations grew 31.5% y-o-y to $43.8 million, primarily due to higher sales of export tooling, medical, and consumer products, partially offset by softer sales from Malaysia and China.

See also: iFast Corp's FY2025 earnings cross $100 million mark

Revenue from the consumer segment also grew to $41.8 million in 9MFY2025 from $39.7 million. The increase was partially offset by lower sales volume for networking & communication and printing & imaging products in China, as well as lower contributions from automotive and power tools segments from Singapore and Malaysia.

Shareholders’ equity as at Sept 30 stood at $131.9 million compared to $136.2 million as at Dec 31 2024. Net cash stood at $48.4 million as of Sept 30, equivalent to 6.4 cents per share.

Looking ahead, Fu Yu is closely monitoring the impact of new tariffs proposed by the US Government on exports from China. As announced on July 29, Fu Yu decided to wind down its Zhuhai facility to consolidate its manufacturing footprint in China and improve operational efficiency.

Shares in Fu Yu are trading 1.9 cents higher or 20% up at 11.4 cents on Oct 30.