With this, the analysts note that policy reforms catalysesd across five themes could give Singapore’s market renewed momentum.

Domestic resilience

Presently, Singapore faces the base-line reciprocal tariffs of 10%.

Should it remain this way after July 8 and key exemptions such as semiconductors, pharmaceuticals remain at 0%, the analysts estimate that Singapore will face an effective tariff rate of 5.1%.

See also: With Temasek’s own shifts, CapitaLand-Mapletree merger has a ‘higher probability’: UBS

On the downside, if slapped with global product specific tariffs for segments such as semiconductors, pharmaceuticals and energy, the effective tariff can rise to 20.3%.

“While these external shocks pose significant risks, we believe Singapore's confluence of domestic factors should provide some offsets unlike in past cycles,” write Wickramasinghe and Toh.

Primary amongst this, they note, is the “ample dry powder” the government carries that can be utilised for stimulus support.

See also: Bank of Singapore prefers Asia ex-Japan equities, neutral on US

They explain: “The accumulated fiscal surplus for the current electoral term is $14.3 billion- which is 1.9% of gross domestic product (GDP). We believe there is potential for a fiscal support package to be introduced in the 3Q2025.”

Government-accumulated surplus

Apart from the existing surplus, Wickramasinghe and Toh note that the government has the option of dipping into past reserves to further shore up stimulus measures, which was demonstrated during the global financial crisis and Covid.

Separately, Singapore is also experiencing a construction boom, with construction contracts awarded jumping 53.8% y-o-y in April, largely driven by public sector mega projects such as Changi Airport Terminal 5 and Tuas Port.

The Building and Construction Authority (BCA) is also expecting construction contract awards this year to range between $47 billion to $53 billion, which beats 2024’s actual awards of $44 billion.

Further, work permit holders in labour intensive industries increased 3.6% y-o- by December 2024, with the total population the highest in 10 years.

“This domestic construction boom could have positive spill-over impacts across industries, we believe driving up consumption and employment. We also expect first order benefits to flow through to construction sector players listed on SGX, broadening momentum beyond just the large caps,” write Wickramasinghe and Toh.

For more stories about where money flows, click here for Capital Section

Positive spill-over from China recovery

Another theme could come from outside Singapore.

Despite trade uncertainty, China’s economy showed resilience, with the nation’s first quarter exceeding expectations by expanding 5.4%.

As a result, Maybank has upgraded China’s 2025 GDP growth to 4.6% from the earlier 4.2%.

On this, the analysts write: “In this backdrop, we expect Singapore corporates to benefit. Nearly two-thirds of Singapore’s largest market cap corporates have material revenues originating from China.”

Should overall economic activity in North Asia ramp up, the pair believe the upswing could begin to show up as earnings upgrades in Singapore.

Accelerating corporate capital returns

Meanwhile, starting 2020, a number of government-linked companies (GLC) including Capitaland, Sembcorp Industries (Sembcorp) and Keppel underwent balance sheet optimisation driven by a changing operating landscape, a drive to enhance return on invested capital (ROIC) and increasing shareholder returns.

This, Wickramasinghe and Toh note, has had a positive impact on driving shareholder returns, with the SCI outperforming the Straits Times Index (STI) by 475% and Keppel by 51% since end-2019 to the present.

Singapore corporates are also sitting on a cash up balance sheet, with mid-cap corporates having more than 10% of assets in cash.

On this, they write: “We believe corporate capital returns and balance sheet optimisation would widen to this segment as investors look for higher returns.”

Overall, the analysts expect dividend momentum to rise in 2025-2027 to 8% compound annual growth rate (CAGR) from 6% CAGR historically, signifying accelerating capital returns outpacing earnings growth, while they forecast 2025-2027 earrings to expand at just 2% CAGR.

Concurrently, corporates have accelerated share buybacks as another avenue of capital returns, with share buybacks as a proportion of total market turnover the highest in a decade so far this year.

Wickramasinghe and Toh write: “We believe increased focus on capital returns could drive more flows to Singapore given yield and returns certainty, in what is already a higher dividend yield market.”

Monetising synergies from the JS-SEZ

An avenue that could also get the pendulum of Singapore’s market swinging is the uplifting of the city-state’s economy through the success of the Johor-Singapore special economic zone (JS-SEZ).

The economies of Singapore and Malaysia, the analysts note, are already closely integrated, with Singapore accounting for nearly 25% of Malaysia’s foreign direct investment (FDI).

“A JS-SEZ, backed by clear policy and strong execution, has the potential to materially uplift economic value creation on both sides of the causeway,” write Wickramasinghe and Toh.

Regionally, the zone could be a competitive advantage in attracting fresh FDI to the SEZ- especially as supply chains migrate south, while also fast-tracking net zero transition.

“We believe Singapore corporates stand to benefit significantly from cost optimisations and new revenue opportunities especially from supply chain shifts,” write the analysts.

They add: “We map sector impact from the JS-SEZ and find it would have positive spillover across the spectrum. This should lead to upgrades in earnings in the medium term, in our view.”

Deploying AI at scale

Finally, Singapore’s national artificial intelligence (AI) strategy, which aims to develop the industry’s infrastructure, best practices and labour pool required could be another regional competitive advantage.

The Maybank analysts note that this is because AI-integration has been a policy priority since 2019, thus giving a head start in deploying these technologies in the public and private sector.

Wickramasinghe and Toh cite the banking industry as an example, where AI technologies and automation has led to a material improvement in productivity.

“Therefore, we believe that Singapore corporates should enjoy improving productivity, lower costs and new revenue opportunities as AI-deployment scales,” write the pair.

Liquidity and the STI

On the Monetary Authority of Singapore’s (MAS) $5 billion equity market development programme (EQDP), the analysts believe the inflow to non-index stocks could deliver a significant boost to market liquidity.

They write: “Indeed, in 2025 year-to-date (ytd), 80% of SGX average daily value (ADV) originated from Straits Times Index (STI) components.”

“If matching is required, where qualified fund managers have to proportionately deploy their own capital, there could be a significant multiplier effect, in our view,” add the pair.

Given clear near-and-medium term catalysts, Wickramasinghe and Toh see that the STI should trade higher.

They raise their end-2025 target to 4185 from 4020, while their 50:50 weighting of bottom-up fundamentals and target price-to-earnings ratio (P/E) and price-to-book ratio (P/B) methodology remains unchanged.

However, they raise their target PE/PB to one standard deviation (s.d.) from mean against the mean valuation earlier.

“At our target the STI is set to achieve a historical high on absolute terms. We believe this is justified given the value proposition under the current market conditions. On a 12-month forward P/E basis, the STI would trade at 13.4 times. This is inline with its long term P/E,” write Wickramasinghe and Toh.

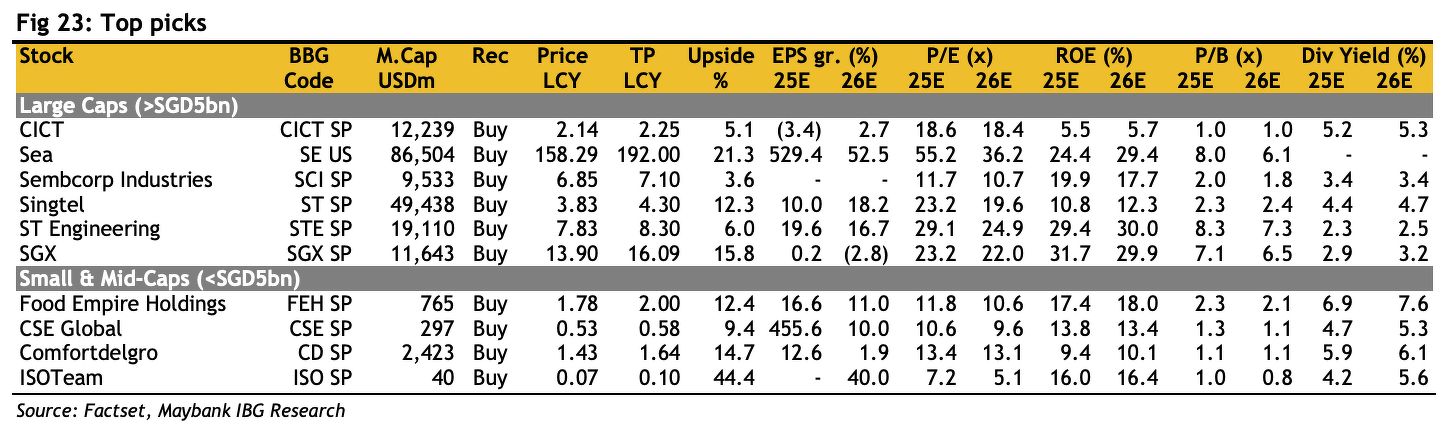

Guided by the highlighted five key themes and policy reforms, the Maybank analysts have a “positive” rating on stocks in industrials, internet, gaming, small-to medium caps, telecom, transport and property developers as well as REIT.

On banks, healthcare and plantations, they have a “neutral” rating, while the pair are “negative” on tech manufacturing.

On banks, healthcare and plantations, they have a “neutral” rating, while the pair are “negative” on tech manufacturing.

Downside risks noted by them include a Trump trade war and US policy uncertainty-driven global recession leading to earnings expectations being sharply downgraded from current levels

Other risks include additional tariffs, particularly on pharmaceuticals and semiconductors, which could result in growth downgrades and trade disruptions, as well as geopolitics and war risks.

This, they note, could disrupt trade and supply chains, giving rise to fresh inflation and heightened risk premiums.