Gold Surges as Mideast Risks, Trade War Fan Haven Demand | Spot price set record above US$3,500 in April

“We want to be the bridge between East and West, and create a more regional-focused benchmark,” Nancy Seah, chief executive officer at Abaxx Exchange, said in an interview. “Singapore isn’t the biggest centre of gold at this point of time, but it is the best place for the model we are introducing.”

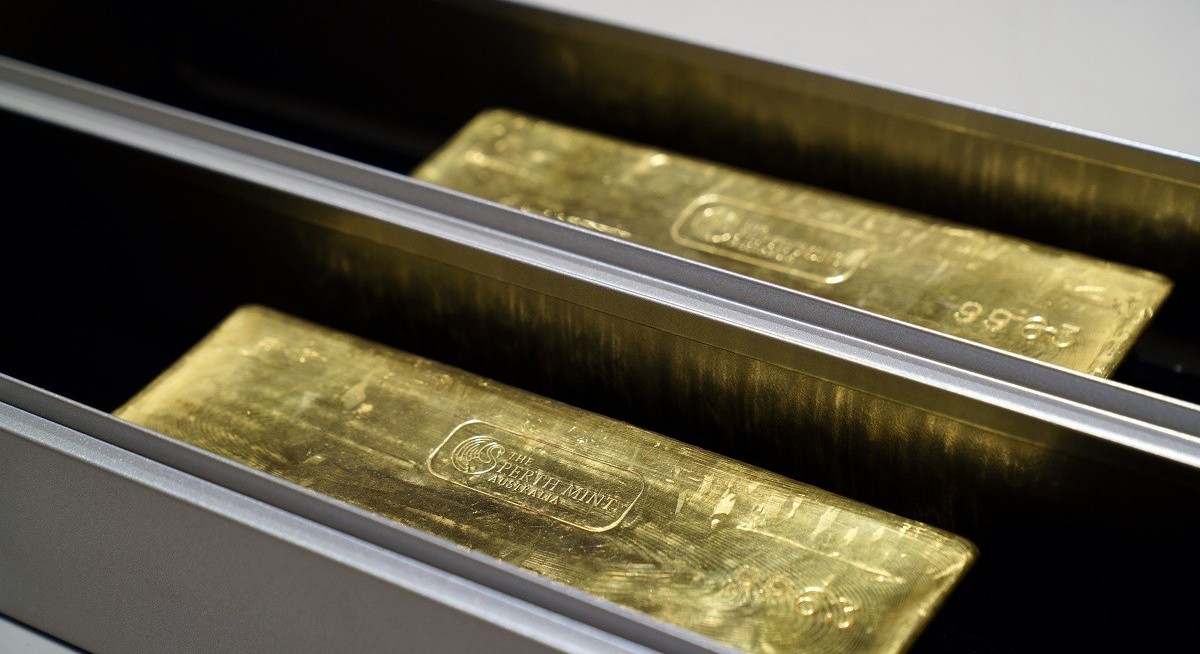

Gold has roared higher this year, setting successive records and peaking above US$3,500 an ounce in April. The surge has been driven by increased haven demand stemming from conflict in the Middle East, trade-war disruptions, as well as jitters about the US fiscal position and doubts about dollar-assets. The metal’s strong gains — which have also been underpinned by sustained central bank demand — have both raised the commodity’s profile and intensified a focus on its role in portfolios.

See also: Gold proxies gain on soaring prices, but ‘be prudent, earnings matter!’ reminds OCBC

Across Asia, there’s a deep affinity, including among high-net worth individuals, for physical metal, as well as burgeoning investor interest. Spot bullion last traded near US$3,426 an ounce, with prices higher on Friday after Israel launched a wave of attacks against targets in Iran. Bullion is headed for a sixth monthly gain, which stands to be the longest such run in more than two decades.

Beyond Singapore, the authorities in Hong Kong have been pressing ahead with efforts to develop the trade in the former British colony. Chief Executive John Lee has said he wants the city to play a bigger role in precious metals, signalling a goal of building “an international gold-trading centre.”

Among industry moves, the Shanghai Gold Exchange — the world’s biggest for trading physical gold — plans to establish an offshore settlement vault in the city. In addition, the Hong Kong Airport Authority aims to expand its storage facility from 150 tons to 200 tons, with a further, eventual boost to 1,000 tons.

See also: Gold rebounds above US$5,000 as historic retreat tempts dip buyers

Ultra-Rich Appeal

“There’s a role for Hong Kong, and there’s a role for Singapore,” said Gregor Gregersen, the founder of Silver Bullion, which opened a vault in Singapore last year. While Hong Kong has more liquidity for gold and silver, with numerous local refineries and supply from China, Singapore’s strength lies in its neutrality, which appeals to the ultra-rich, he said.

The industry gathering — the Asia Pacific Precious Metals Conference — will take stock of regional developments, as well as in London, the traditional centre. Scheduled speakers include David Tait, CEO of the producer-funded World Gold Council; Ruth Crowell, head of the London Bullion Market Association; as well as UBS Group strategist Joni Teves.

“London has seen intense competition over the years,” said Ross Norman, head of Metals Daily, an industry website. Its vulnerability has been a slowness to adopt new technology for trading, settlement and clearing, and that’s where players like Abaxx and other regional hubs can find an opening, he said.