To put it more bluntly, the participants’ economic prosperity depends on their ability to export goods and services to China.

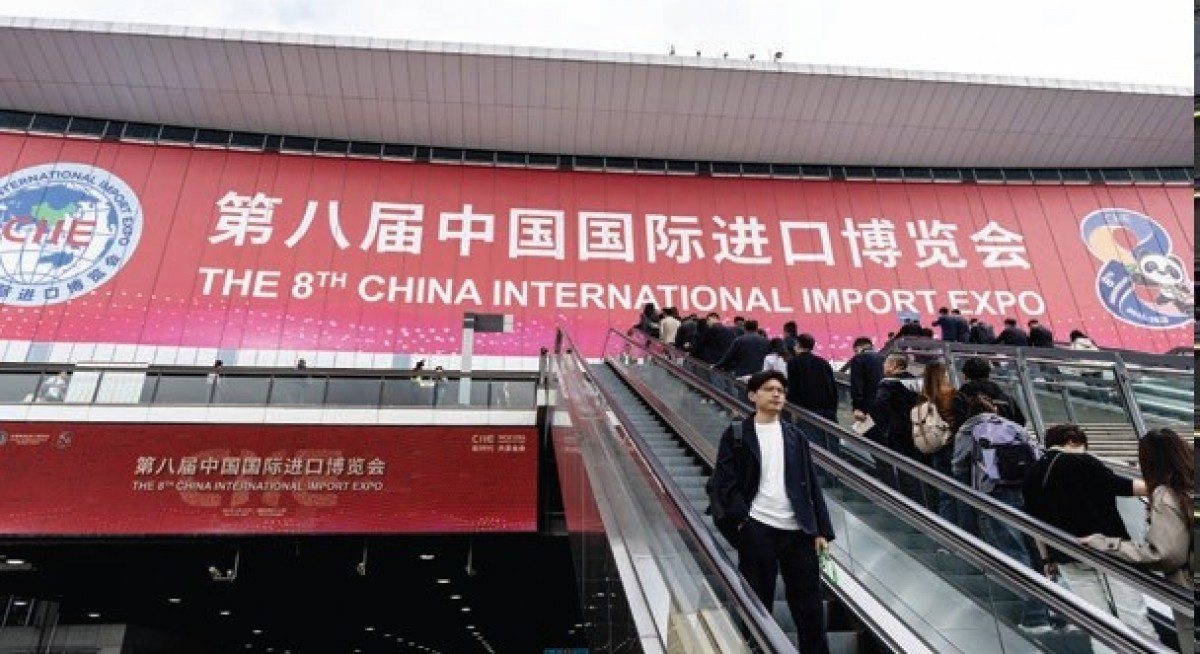

The competition is fierce, and the range of goods and services on offer is extensive. Singapore had an extensive pavilion promoting several dozen companies. Singapore banks took a major presence, highlighting their engagement with the China economy.

In the American market, President Trump forces country leaders to go to the White House as supplicants seeking favourable treatment with the tariffs and the lifting of sanctions. It has turned international trade into a punitive relationship.

The CIIE is the exact opposite approach. The more-than-4,100 exhibitors want to be there. They want to have China import their goods or services. There is no punitive factor involved. China remains the most attractive market in the world for exporters.

See also: Taiwan may push back timeline to meet green energy goal after missing it last year

European markets are moribund, stuck in a low-to-no growth lane for years. US markets are contracting as tariffs eat away at profit margins. Exporters to the US are facing fresh obstacles every day, many of them erratically imposed and adjusted at whim. This creates an unstable and unreliable trading environment.

In contrast, a growth market is found in China. This is an expanding economy, both currently and into the future. Growth is around 5%. Neither the US nor European markets can match this growth potential. They are mature markets whose growth has largely stalled at around 2%. They are not likely to reach a 5% growth target.

Export industries based outside of China need growth markets to export to. China is the primary market with room to continue growing. It is an economic reality even though political considerations sometimes suggest otherwise.

See also: CK Hutchison seeks damages via arbitration on Panama Ports

Often, the economic narrative about China is the slowdown in China’s exports to the US and Europe. It makes a good story for some of the news media, but the reality is different. China’s exports continue to grow into new markets in the Global South.

But, CIIE is the other side of the coin. This is about the goods and services China imports to support its growing economy. These imports feed domestic consumption — domestic industrial consumption, but increasingly also domestic consumer and services consumption.

China is again a hot market. Flights from Singapore to Shanghai or Beijing are filling up, with business-class passengers all keen to do business with China. The increased number of exhibitors at CIIE in 2025 strongly suggests that China’s domestic demand, both industrial and consumer, is strong and growing.

Technical outlook for the Shanghai market

The Shanghai index rebounded strongly from the upper edge of the long-term group of averages in the Guppy Multiple Moving Average (GMMA) indicator. The strength of the uptrend was never in doubt as the long-term group of averages did not show any compression in response to the market retreat.

The lack of compression signalled a temporary pullback and a buying opportunity.

The separation between the short-term GMMA and the long-term GMMA remains steady and consistent. A rapid and wider separation indicates the development of a bubble environment. A narrowing of the separation is an early warning of trend weakness.

For more stories about where money flows, click here for Capital Section

Neither of these conditions have developed and this suggests the trend is stable and most likely to continue towards the upside target near 4,100.

The upside target is calculated by measuring the width of the trading band and projecting this value upwards.

The 4,100 target level is also validated using the upward-sloping triangle pattern created by trend line B and resistance level line A. The base of the triangle is measured and projected upwards to give a target near 4,050. This measured move is slightly below 4,100. It is reasonable to set an upside target of between 4050 and 4,100, but the strength of the GMMA trend suggests the 4,100 target can be achieved.

The long-term group of averages in the GMMA are not compressing, confirming that investor support for the trend remains strong.

The long-term GMMA provides support for any market retreat. The next support feature is the old resistance level near 3,888. After Nov 18, the long term trend line A will cross the resistance level near 3,888. When that happens, trend line A will be the next support feature.

The trend behaviour remains bullish. The index could pull back to the current value of the long term uptrend line A and still remain in a bullish uptrend.

Daryl Guppy is an international financial technical analysis expert. He has provided weekly Shanghai Index analysis for mainland Chinese media for two decades. Guppy appears regularly on CNBC Asia and is known as “The Chart Man”. He is a former national board member of the Australia-China Business Council. The writer owns China stock and index ETFs